Recording Interest

In Finance Hub, you can easily record interest by following the steps below:

- Navigate to Finance|Accounts Receivable|Revenue Posting|General Ledger.

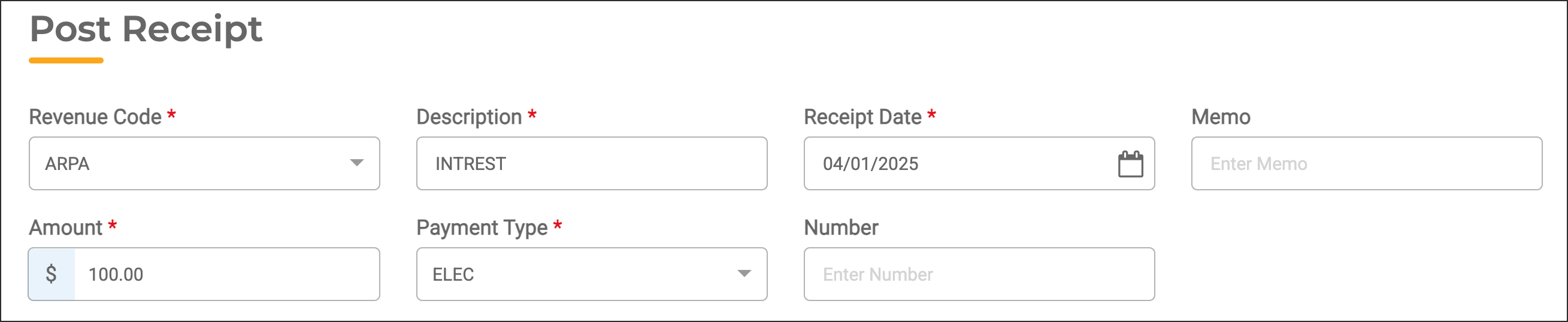

- Click Post Receipt.

- Select the appropriate Revenue Code.

Note: Each bank that bears interest needs to have a Revenue Code.

- In the Description field, enter “INTEREST”.

- Enter the Receipt Date (this should match the date on your most recent bank statement).

- Enter the Amount.

- Under Payment Type, select ELEC (Electronic Payment).

- Distribute the interest amount across the desired GL Accounts.

- Click Post & Pay.

You can find the posted receipt by searching under Finance|Accounts Receivable|AR Recipet Run|General Ledger.