Accounts Receivable Electronic Deposits

Electronic Deposits are any revenue deposited automatically into your bank account that is not processed through FrontDesk or other modules. Common electronic deposits are property taxes received from the county, state grants and reimbursements, loan proceeds, and bank interest earned.

Electronic deposits are entered in the Finance Hub > Accounts Receivable and will automatically be assigned receipt numbers and listed on the Receipt Report. Each electronic deposit should be posted individually to match your bank statement. You may want to wait until you receive your bank statement to verify amounts and dates before posting electronic deposits.

AR Electronic Deposit Process

The Accounts Receivable Run for electronic deposits is a simple three-step process. Additional detail on each of these steps is provided below.

- Post Electronic Receipts & select dates to match your bank statement.

- Create the Receipt Report & verify the Receipt Report is accurate.

- Process the Receipt Run for each Electronic Deposit individually.

1. Posting Electronic Receipts

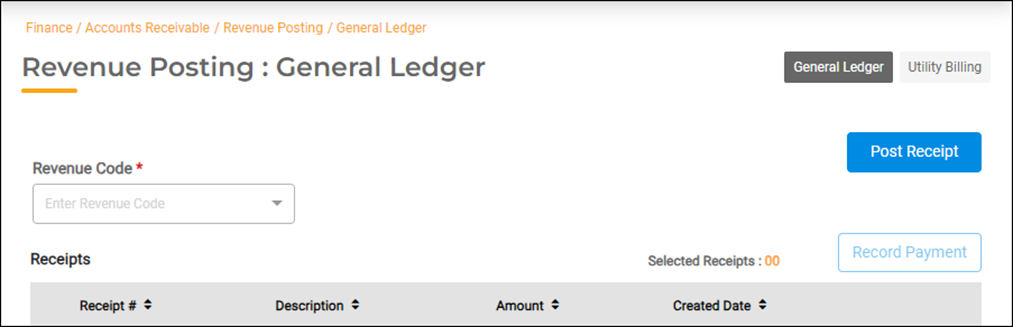

In the Finance Hub, select Accounts Receivable > Revenue Posting. The Revenue Posting screen defaults to General Ledger. Click the Post Receipt button.

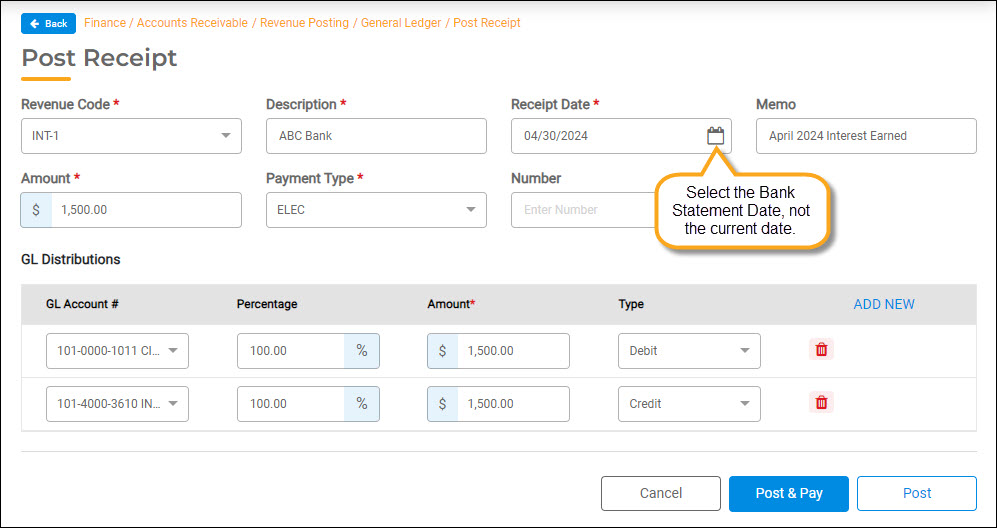

After clicking the Post Receipt button, the Post Receipt screen will display.

- Select the Revenue Code you need. You can scroll through the drop-down list, or type all or part of the revenue description, such as INT to select from codes with similar descriptions.

- In the Description field, enter the name of the bank, or agency you have received the payment from. This description will build historical data in the General Ledger for your government agency and auditor.

- Select the date you see on your bank statement for the deposit in the Receipt Date field. Be careful not to select the current date when entering deposits and interest for the previous month.

- Enter a Memo describing details about the payment. This description will also build historical data in the General Ledger.

- Enter the payment total that you received in the Amount field.

- Select the electronic Payment Type from the drop-down list.

- Enter Percentages or Amounts in the GL Distributions fields (see the following section for more information).

- Click the Post & Pay or the Post button to save the receipt and post the revenue. Further instructions are provided below.

General Ledger GL Distributions

The debit and credit accounts, pre-determined for the Revenue Code you selected, will default in the GL Distributions section of the Post Receipt screen. You can click ADD NEW to add another account number and click the red trash can to delete an account number. The account Type (Debit/Credit) defaults for the accounts listed.

Revenue Codes are created with or without percentage amounts.

- When Percentage fields are blank, you can manually distribute the total revenue in the Amount fields. The percentages will auto-populate as you enter these amounts.

- When Percentage fields have default values, these values do not act to auto-populate the Amount fields. This allows you to change the percentage amounts if needed. Key in the Percentage amounts and the Amount fields will auto-populate.

- All Credits must add up to 100% of the amount received. All Debits must add up to 100% of the amount received. In addition, Credit and Debit totals must be equal in each Fund to prevent cross-fund posting.

Saving Receipts using the Post & Pay Method

The Post & Pay button posts the receipt right away. Use this method if one Revenue Code and one Payment Type are required for posting the payment you received. You can delete and re-enter a receipt using Post & Pay, but you cannot edit the receipt after posting

Saving Receipts using the Post Method

The Post button requires an extra step to post the receipts before printing them. Use the Post button when you want the opportunity to edit a receipt before posting it. Read the help doc, Saving Receipts using the Post Method, for further instructions.

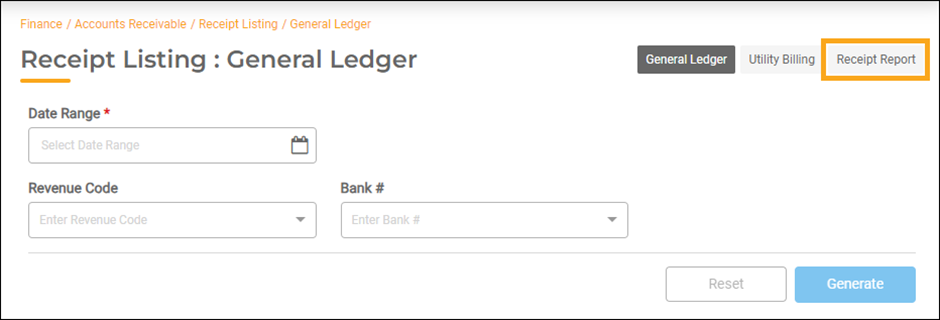

2. Print the Receipt Report

Create the Receipt Report and verify that what you entered matches your bank statement.

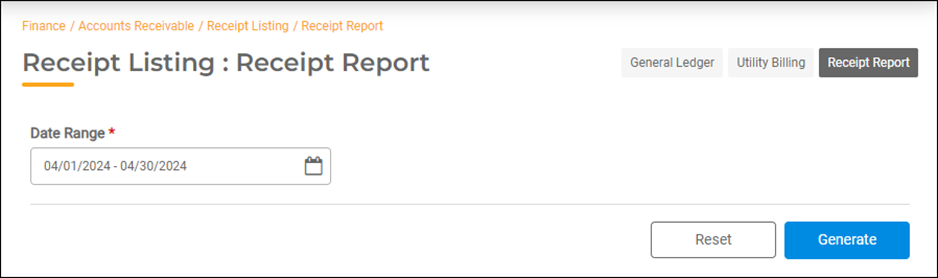

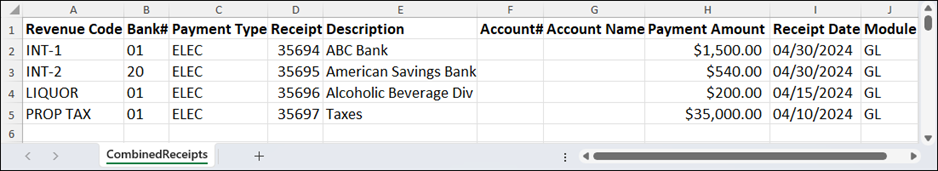

- Select Accounts Receivable > Receipt Listing and click the Receipt Report button at the top right of the screen. Finance Hub will create an Excel spreadsheet that lists the payments you entered. The spreadsheet is downloaded to your download folder.

- On the Receipt Report screen, select the Beginning and Ending dates for the bank statement month in the Date Range field, then click the Generate button.

- Find the Excel spreadsheet in your download folder and open it. If other payment types are included in the list, you can use the Data Sort feature to arrange the receipts by Payment Type, and group the electronic deposits. Verify that deposit amounts and dates match your bank statement. If they do not match, read the help doc Maintaining Receipts for further instructions.

3. Processing Your Receipt Run

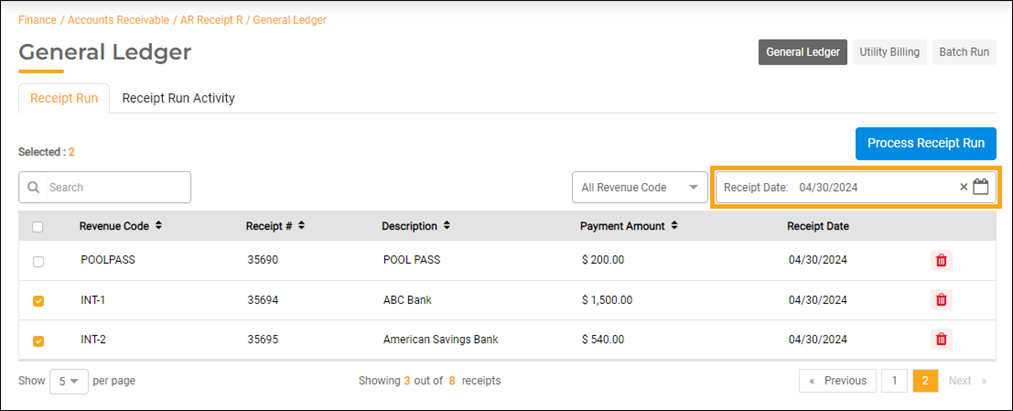

Once you have verified that your deposit is correct, the final step is to update receipts by Processing the Receipt Run for each date.

Select Accounts Receivable > AR Receipt Run.

- In the Receipt Update Date field, select the date of the first electronic deposit listed on the Receipt Listing.

- Select this receipt from the list by clicking to check the box in the first column. If you have other receipts on the same date that will be updated to different Banks, you can select all of them and process them together (such as Interest). Otherwise, each electronic receipt should be processed one at a time, to make reconciling your bank statement easier.

- Once you have selected the receipt(s), click the Process Receipt Run button. A Process Receipt Run question will pop up. Click Process to update the General Ledger and the Bank.

- Repeat steps 1-3, working your way down the receipt listing for each electronic deposit.