Managing Deposits

Most Agencies require their citizens to pay deposits when setting up a new Utility Account or Service within an Account. Deposits can be assessed for each individual Service within a Utility Account. The deposit will then be associated with a Public User for a specific service. You can configure deposits so that they will get charged automatically based on the rules you set.

- Global Settings for Deposit Configuration, including the default deposits amount for each Service, are configured in Settings > Billing Deposit Management.

- Viewing existing deposits, along with outstanding Balances and Refunds, is in UB Accounts > Deposit Management.

- You can view the deposit associated with an individual Utility Account within the Deposits section of that Utility Account's details page.

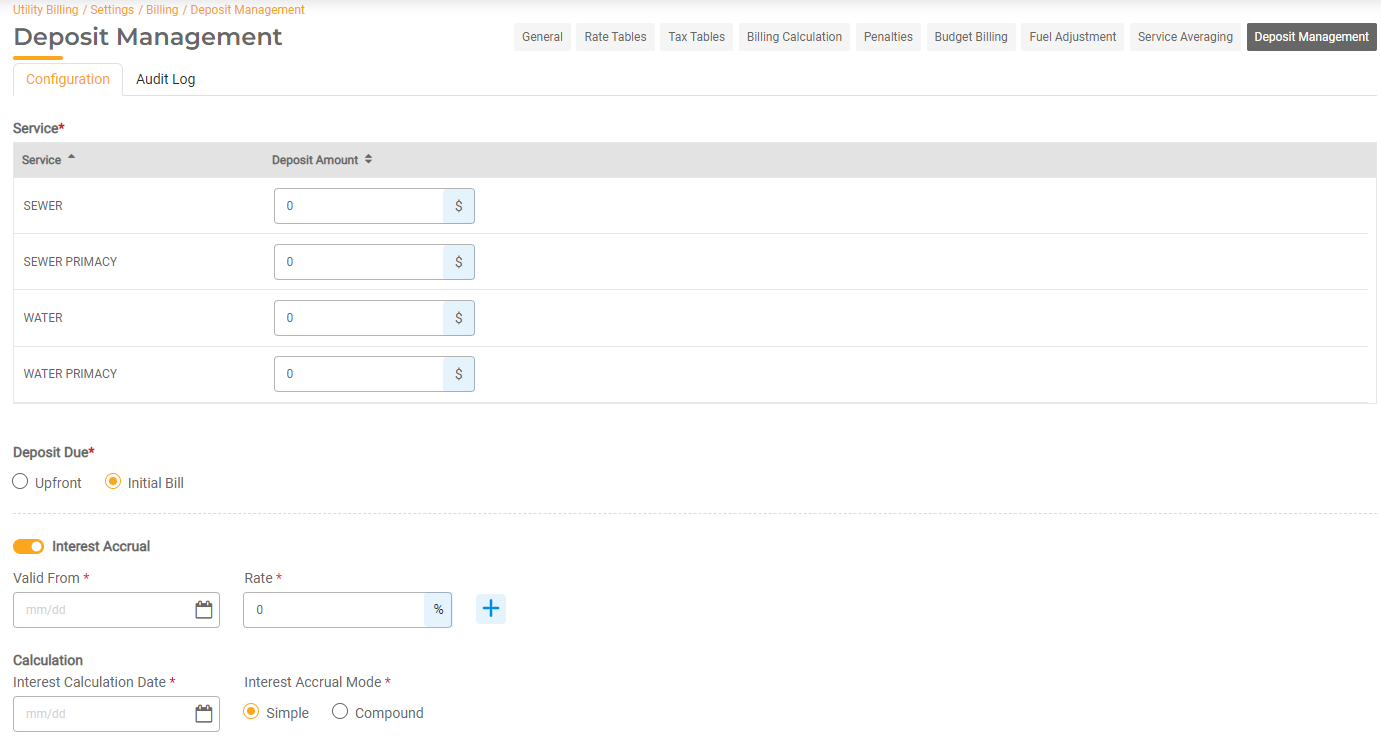

Deposit Configuration

You can configure global settings for deposits in Utility Billing > Settings > Billing > Deposit Management. Deposits are configured so they can be applied automatically for any Service. Use this page to set the deposit amount to be charged by service type, when the deposit should be collected, interest calculations, and how to apply deposit refunds.

- Deposit Amount: Enter the deposit amount by Service. Each active Service you have set up will display here. You can input the Deposit Amount for each applicable Service.

- Deposit Due: Determine whether the deposit is due Upfront or with the Initial Bill.

- Upfront: If the deposit payment is due before a new Service or Utility Account can be set up, the deposit will need to be paid before the Move In Request or Start Service Request can be finalized. In this case, the Move In Request or Start Service Request will remain on hold until the payment is received. The Account status will also display as On Hold until the deposit payment has been received.

- Initial Bill: If the deposit is included with the initial bill, the deposit will display as a line item on the utility bill. Any time a deposit refund occurs, the refund amount will display as a line item on the bill.

- Interest Accrual: If your Agency applies interest to deposits, turn this toggle on. You can then set the annual interest rate calculation. The interest will be generated based on the schedule you enter below.

- Valid From: Enter the start date that determines when interest should start accruing. You may have multiple interest rates. In this case, you can click the + button to add another rate and applicable date range. The Valid From date (start date) for the latest rate you entere will determine the End Date for the previous record. Initiall you may have one rate that will be active. tart date for the latest rate they enter determines the End date for the previous record. So when you add another rate, the new rate will become applicable from its start date and the previous one will be only applicable until the day before. This way, the system can calculate deposit interest on the fly by keeping a record of interest rates across time periods.

- Rate: Enter the Interest Rate as a percentage.

- Interest Calculation Date: Enter the date the Interest will be calculated each year. The interest calculation will occur automatically on an annual basis based on this date.

- Interest Type: Simple or Compound.

- Apply Refund to Final Bill. Turn this toggle on if the interest should automatically apply as a refund on the final bill. If this is turned on, the interest will automatically calculate and refund the amount during the final bill process workflow. If this is turned off, you can refund the deposit manually.

Deposit Interest Calculation

Deposit Interest can be calculated as Simple or Compound Interest based on the interest rates you have configured. Interest will be calculated based on Interest Accrual Start Date. The interest will be calculated on any deposit held based on the payment date it was received.

Simple Interest is calculated on the original amount of the deposit only.

Compound Interest is calculated on the original amount of the deposit plus the accumulated interest of the previous periods.

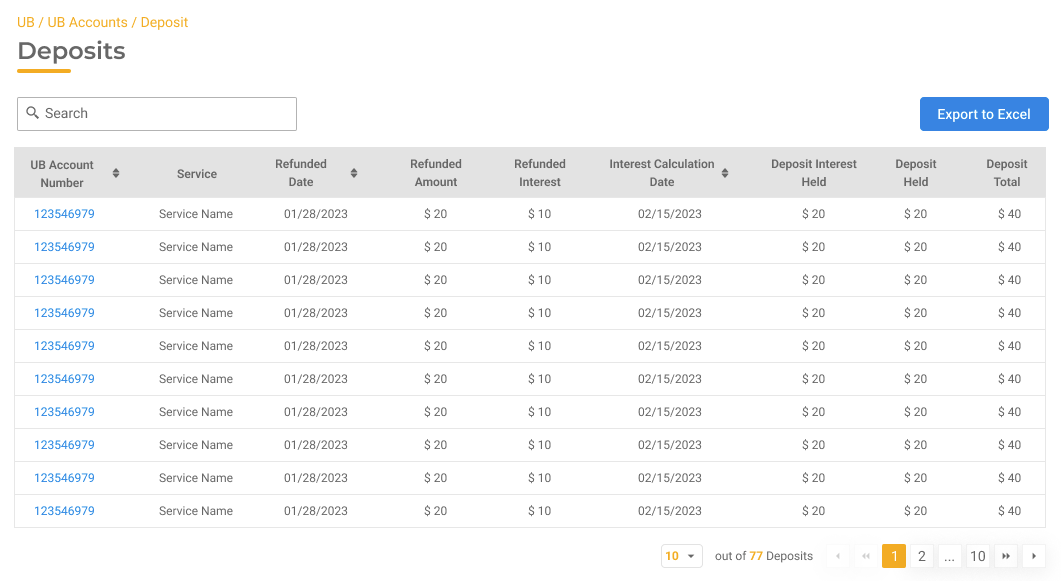

View Deposits

You can view all deposits and associated status for all Utility accounts in the system in Utility Billing > UB Accounts > Deposits. You can export the Deposit list by clicking Explore to Excel.

To manage individual deposits or issue refunds, select the Account link so you can manage the deposit within the Utility Account details page.

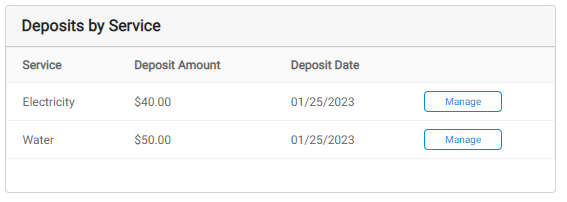

Managing & Refunding Deposits

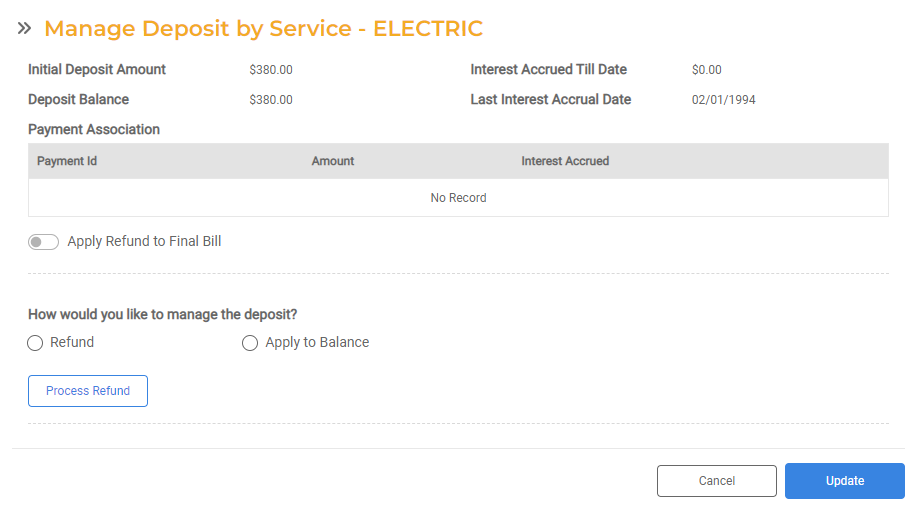

You can view Deposits by Service within an individual Utility Account. Within the Utility Account's Detail Page, you can view the Deposits by Service section. Click Manage next to a deposit to view the breakdown of the deposit associated with that Service.

Within the deposit section of the Utility Account Details, you can view Amount Owed, Amount Held, Payment Association, Payment Date, Interest Accrued, Interest Accrual Date, Refund Amount, Refund Interest, Refund Date, and Refund Type.

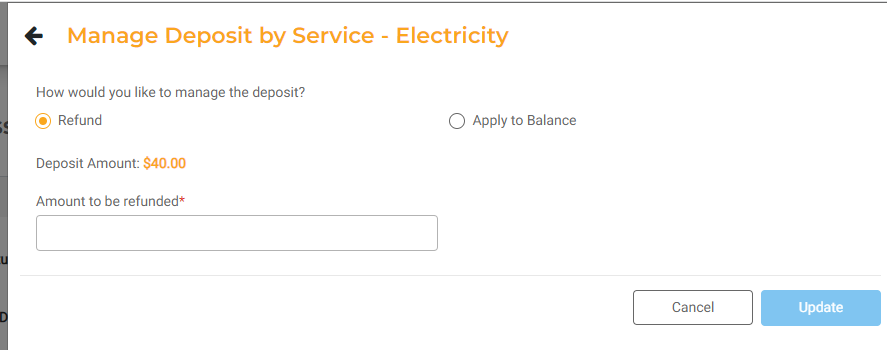

You can also refund a deposit from the deposit details screen. This will allow you to refund a deposit or apply a deposit to an outstanding balance, even if your global settings are set to apply the deposit to the final bill. Select whether the deposit will be refunded or applied to the balance. Enter the amount to be refunded and click Update.

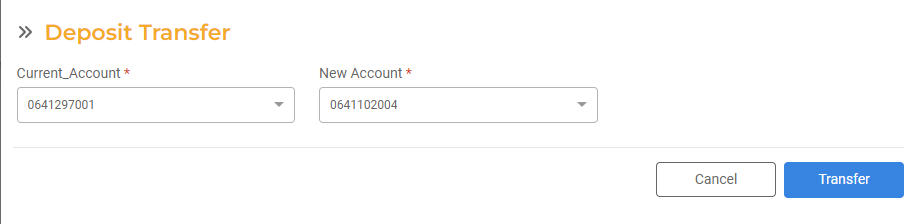

Transferring Deposits

You can transfer a deposit to a new Utility Account if the Public User is moving to a new Service Location within the city. To transfer a deposit from one Utility Account to another, Click Transfer Deposit in the Deposit Management Page (Utility Billing > UB Accounts > Deposit Management).

Select the Current Account you are transferring from and the New Account you are transferring to. Click Transfer to proceed. The deposit amounts will be transferred to the same Services at the new Utility Account.