Payment Failures & Forte Error Codes

Payment Status

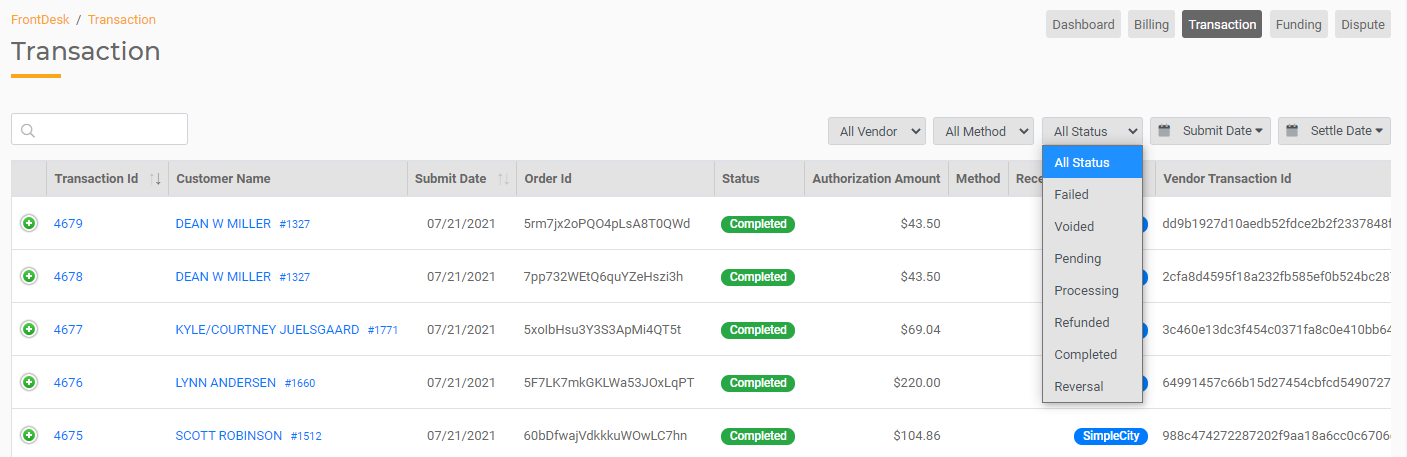

All payments are processed by Forte. These transactions are displayed in the Transaction sub-tab in Payments. If the transaction was processed successfully, the status will show as completed. You can also see if a payment failed, has been voided, reversed, or refunded.

Payment Failures

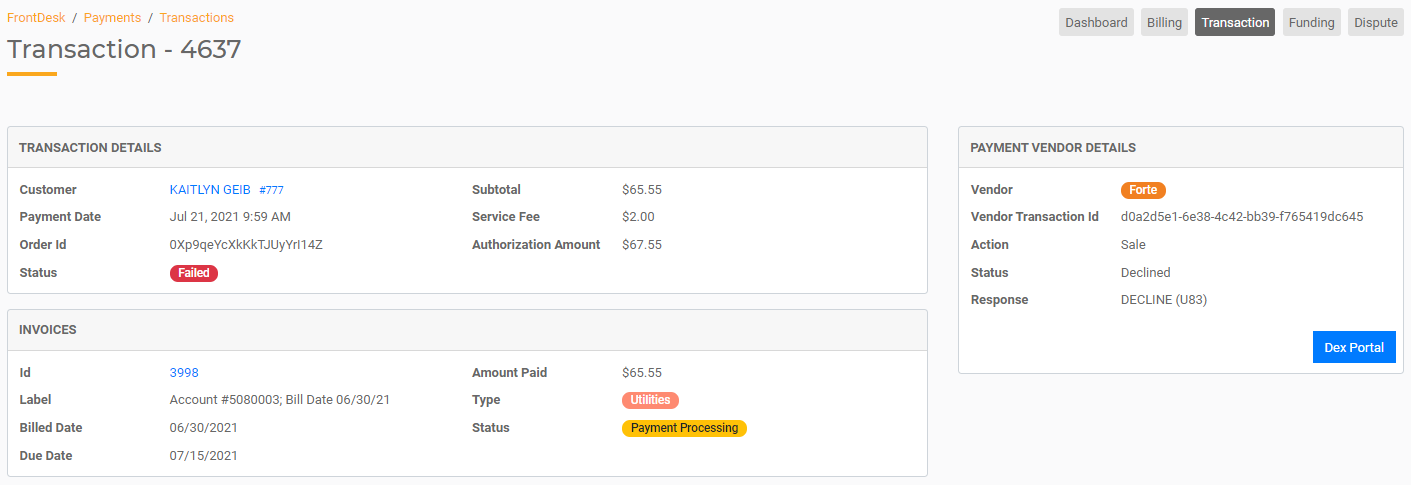

In the event a payment failed, there may be several reasons for the failure. You can view the transaction and, based on the code provided by Forte, understand why the payment failed.

First, open the specific transaction by clicking on the Transaction ID from the table. This will provide more details about this specific transaction including payment vendor details. The Payment Vendor Details section contains a transaction ID, Action, Status, and Response. The Response line will display a description along with a code provided by Forte. You can use this line to understand why the payment failed.

Forte Transaction Response Codes

Transactions that are accepted for processing return the A01 response code. Transactions that are rejected for processing return the "U" response codes. The table below is a list of the various codes from Forte that may be in the Response line and what they mean. Please keep in mind that gWorks has no control over these codes; they are provided by the payment vendor as a direct result of the payment process. The information below is provided by Forte - any questions or concerns about these items should be addressed directly with them. For more information, review Forte's Transaction and Settlement Codes.

Code | Description | Comments |

|

| Transaction approved/completed |

|

| Transaction approved for a partial authorization (credit card only) |

|

| The customer is either: |

|

| Merchant daily limit exceeded (EFT only) |

|

| Merchant monthly limit exceeded (EFT only) |

|

| AVS state/area code check failed. Ensure that you've entered the correct zip code and state abbreviation. |

|

| AVS state/area code check failed. Ensure that you've entered the correct area code for the phone number and state abbreviation. |

|

| AVS anonymous email check failed. Ensure the customer's provided email address is not from a free service like hotmail.com or gmail.com. |

|

| Merchant has exceeded the maximum number of transactions per hour, which may indicate a security problem. This error rarely occurs, but if you receive it, contact Forte by calling Customer Service at 800-337-3060 option 1. |

|

| Merchant has exceeded the maximum number of transactions per hour, which may indicate a security problem. This error rarely occurs, but if you receive it, contact Forte immediately by calling Customer Service at 800-337-3060 option 1. |

|

| The transaction has the same attributes (e.g., authorization amount, payment method, billing address, etc) as another transaction within the time set by the merchant in Dex echeck settings. If you do not set a Duplicate Timeout time, Forte defaults to five minutes. |

|

| The recurring transaction cannot be found. This error will trigger when a recurring transaction cannot be identified when attempting to suspend, activate, or delete a recurring transaction within a schedule. |

|

| The original transaction is not voidable or captureable. Transactions in the following statuses can be neither voided nor captured: |

|

| The original transaction that you are attempting to void or capture cannot be found. Ensure the original_transaction_id included in the request is correct. |

|

| This error occurs when you attempt to void a credit card transaction with the authorization code from an echeck transaction or when you attempt to void an echeck transaction with the authorization code from a credit card transaction. |

|

| The transaction was previously voided or captured. |

|

| The void or capture operation failed due to a malformed request. Ensure the authorization number and amount match the original transaction you wish to void or capture. |

|

| The provided Bank Routing Number is invalid. Ensure you entered the correct routing number and try again. |

|

| The provided credit card number is invalid. Re-enter it and try again. |

|

| The start date of the submitted schedule is in the past or is not in MM/DD/YYYY format. Schedule start dates must be today's date or greater. If you do not specify this value, Forte uses today's date. |

|

| The provided swipe data is malformed. This could mean it's missing characters or was not copied over correctly. Re-swipe the card and attempt the transaction again. |

|

| The provided expiration date is malformed. Expiration dates must conform to MM/YYYY or MM/YY formatting and be a valid future date. |

|

| The authorization amount is negative. |

|

| The transaction request contains invalid data. This could mean you've included fields that are not part of the objects in the request or fields that are irrelevant to the request. Double-check the request before submitting it again. |

|

| The merchant sent a convenience fee but is not configured to accept one. Only convenience fee merchants can accept convenience fees. |

|

| The merchant is configured for a convenience fee and either did not send one or sent the incorrect amount for the convenience fee. Convenience fees can be either a set amount or a percentage of the authorization amount. |

|

| The convenience fee transaction of a SplitCharge failed. The SplitCharge service model is where two transactions are processed: one amount is for the principle, and the other is for the service fee. This error triggers when the service fee transaction (i.e., the charge that goes to Forte) fails to process. |

|

| The principal transaction of a SplitCharge failed. The SplitCharge service model is where two transactions are processed: one amount is for the principle, and the other is for the service fee. This error triggers when the principal amount of the transaction (i.e., the charge that goes to the merchant) fails to process. |

|

| This error occurs when a merchant attempts an operation that is not available in the sandbox environment (e.g., disputes can only be retrieved in Live). You may not be live because of contract or testing issues. To check your live status, call Forte's Customer Service Team at 800-337-3060 option 1. |

|

| This error occurs when a credit-card-only merchant attempts to send an echeck transaction or when an echeck-only merchant attempts to send a credit card transaction. Check your merchant configuration in Dex to determine what services your configured to use. |

|

| The transaction amount exceeds the merchant's maximum transaction limit (echecks only). To proceed with the transaction, the merchant must complete the Over Transaction Limit Notification form and fax it to the number listed on the form. |

|

| Your merchant account's configuration requires updating. Call Forte's Customer Service Team at 800-337-3060 option 1. |

U78 | DISALLOWED ACH SEC CODE | Merchant accounts are configured for specific SEC codes. Most merchants are configured to support WEB, TEL, PPD, and CCD SEC codes. When a merchant attempts to send a non-configured SEC code (e.g., BOC or ATX), this error is triggered. |

|

| Transaction was declined due to a pre-authorization (Forte Verify) result. Forte Verify is a subscription service that looks up the status of an echeck account to determine if the customer account is valid and in good standing. To view the specific reason why an account was declined, see the preauth_result, preauth_desc, and preauth_neg_report fields in the response. |

|

| The pre-authorizer not responding (Forte Verify transactions only). This error indicates that the Forte Verify service has timed out and cannot retrieve a value for the preauth_result. Wait 5-10 minutes before retrying the transaction. |

|

| Pre-authorizer error (Forte Verify transactions only). This error indicates the Forte Verify pre-authorizer is experiencing a problem. Wait 5-10 minutes before retrying the transaction. If the error persists, submit a ticket to Forte Customer Service. |

|

| The transaction was declined by the authorizer. To determine the reason for the declination, contact the number on the back of the card. |

|

| The authorizer is not responding. Wait 5-10 minutes before retrying the transaction. |

|

| Authorizer error. This error indicates that the authorizer is experiencing a problem. Wait 5-10 minutes before retrying the transaction. If the error persists, submit a ticket to Forte Customer Service. |

|

| The authorizer's address verification services failed. Ensure the billing address for the transaction was correctly submitted and try again. |

|

| The authorizing vendor is busy. Wait 5-10 minutes and resubmit the transaction (credit cards only). |

|

| The verification vendor is busy. Wait 5-10 minutes and resubmit the transaction (Forte Verify transactions only). |

|

| The authorization service is unavailable. Wait 5-10 minutes and resubmit the transaction (credit cards only). |

|

| The verification vendor is busy. Wait 5-10 minutes and resubmit the transaction (Forte Verify transactions only). |

|

| A batch transaction was voided |