Tax Exemptions

Certain Utility Accounts or Services can be Tax Exempt or partially Tax Exempt. The property level will set which tax authorities that property is subject to. Tax Exemption may be set at the individual Utility Account. Sometimes this is by Account Type, such as Non-Profit or Government. Within an Account, an individual Service may be taxable, tax-exempt, or only a percentage tax-exempt.

Each Service for each Utility Account is associated with a Tax Table which determines the default taxation for that Account. The Tax Table settings may be overridden in the case of Accounts or Services that are exempt.

For more information on Tax Tables, see How to Configure Rate Tables.

Account Tax Exemptions

You have the option to override taxation for each Taxing Authority at an individual Utility Account.

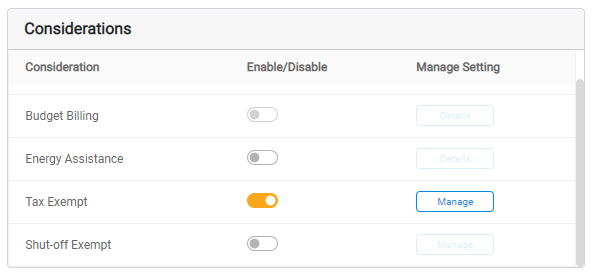

To make an individual Utility Account exempt from taxes, open the Account Details page. Within the Considerations section, turn the Tax Exempt toggle on. To track the Tax Exemption ID for this Account, click Manage, enter the ID number, and then click Save.

Service Tax Exemptions

You may allow tax exemption for specific Services within a Utility Account. In addition to the ability to override Taxation at the Utility Account, Tax Exemption can be set for each Service within each Utility Account.

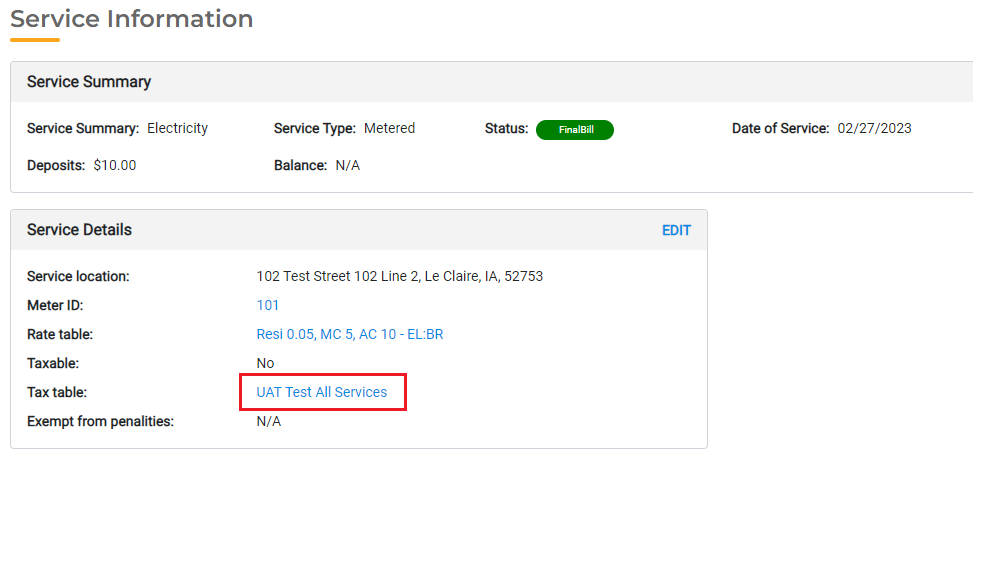

To update the Taxation Settings for a specific Service, open that Service from the Account Details page. This will open the Service Information window. Click the link next to the Tax Table to view and override the Taxation for this Service.

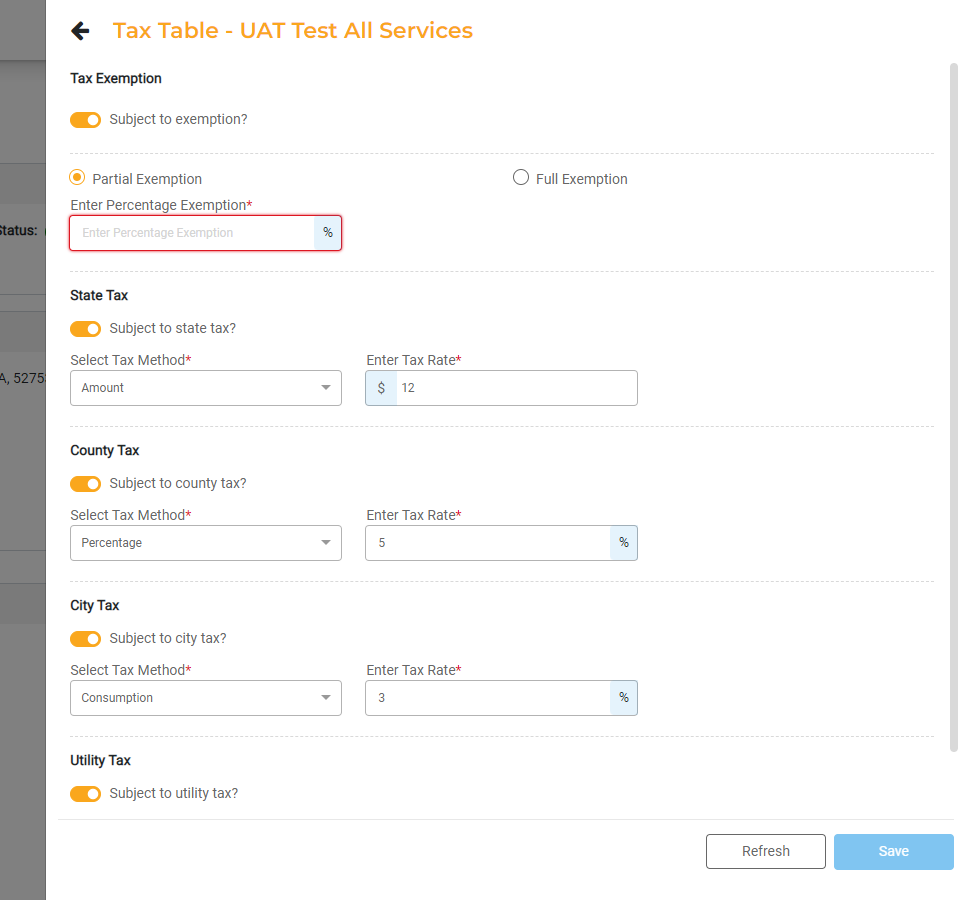

You can see the Tax Table and designated Tax Rate associated with the Service through the Tax Table. Here you can select a different Tax Table, update the rates for each Tax Authority, or make the Service partially exempt.

If the Service should be fully exempt or partially exempt from taxes, turn the toggle for Subject to exemption on.

- You can select Partial Exemption and input the percentage to which that Service should be partially exempt.

- You can select Full Exemption to make that Service completely exempt from Taxes.