gWorks Payments Procedures

This article provides an overview of the differences between Forte and gWorks Payments which are useful for those transitioning to gWorks Payments.

gWorks Payments Vs Forte

Key Differences

- The cutoff time for paymetns is 12am with Forte. All payments received prior to 12am will be recorded on that day and all payments received aver 12am will be recorded the next day. This will be visible in your Receipt Listing. The cut-off time wtih gWorks Payments is 8:30pm CST, so all payments received after 8:30pm will be recorded the following day.

- Forte sends a daily email with the payments submitted the previous day. With gWorks Payments, we built configurable reporting directly in the Payments tab of FrontDesk so you can access and download payment reports any time you choose. For more information on reporting, follow the instructions listed here.

- For any support related to gWorks Payments, you can now reach out to gWorks Support Representatives directly rather than rely on a third party.

gWorks Payments Fees

Agencies accepting payments will be charged 2 types of fees:

- Monthly recurring charge. This is a monthly $5 fee deducted from your account regardless of payment volume. This fee is for the Account Updater service that gWorks provides that will automatically update expired credit cards to reduce the change of missed or failed payments.

- Variable Charges. These fees are deducted on a "per transaction" basis. For example, if your agency absorbs any of the service charges for credit or ACH payments, you will incur a fee for each transaction processed on FrontDesk. Most Agencies pass these fees along to the citizen, removing any per transaction fees from the Agency.

What does this mean for you?

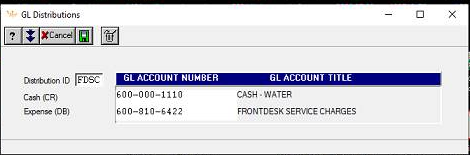

There will be an expense account created in your GL distribution for FrontDesk Service Charges. Any related payment processing fee that the city incurs will automatically be recorded under that account. Below is only an example of what your expense account may look like, but you can view the expense account created for you under Bank Reconciliation > options > GLDIST, then enter FDSC followed by F12 to pull up the distribution ID.

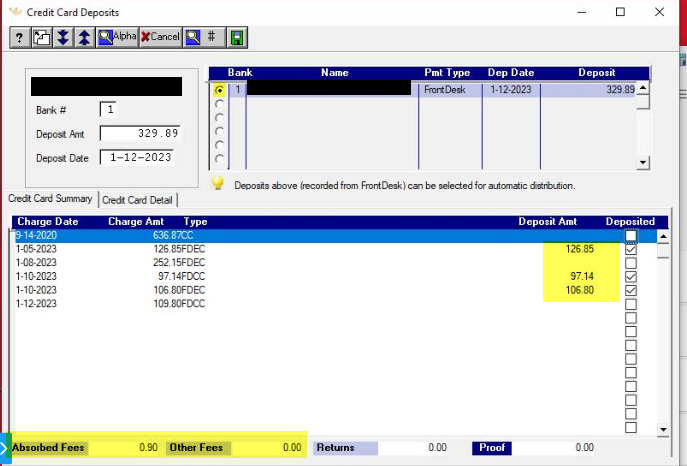

Handling gWorks Payments Bank Reconciliation

For any fees you as the Agency absorb on behalf of the citizen, these fees will “net” out of your daily deposits from gWorks Payments into your bank account. The $5.00 Account Updater Service fee will "net out” or be paid out of the first deposit for the month. These fees will be expensed automatically to the FDSC Expense account setup. As you “clear” your CC DEP by clicking on Dep total in top right corner of the CC Dep screen, any fees “netted” or paid out of respective deposit will display in same CC Dep screen and be reported on the CC DEP posting journal that prints out after Reconciliation.

The screenshot below demonstrates how a gWorks Payments Deposits would be “reconciled” and/or “Pushed” to the Bank Reconciliation Module.