Managing Payments Without FinanceHub in FrontDesk

Overview

When customers make payments through FrontDesk, gWorks Payments deposits the funds into your bank account. Without FinanceHub, you’ll need to manually review:

- Who made payments

- What makes up each deposit

- What standard fees are deducted

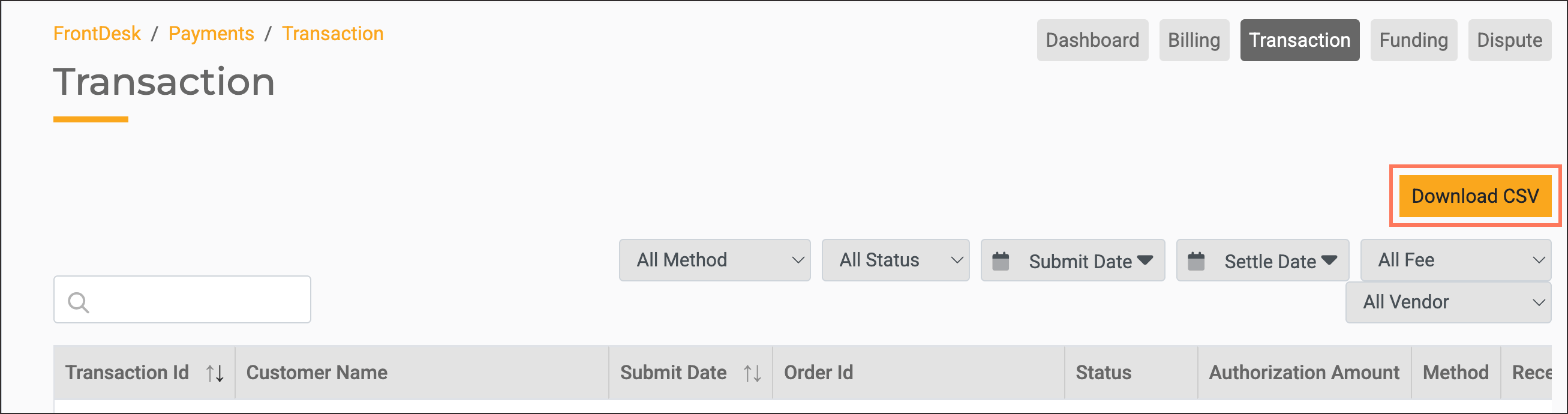

Viewing Customer Payments

To see who made payments on a specific day:

- Go to FrontDesk|Payments|Transactions

- You can Filter the transactions by Vendor, Payment Method, the status, dates, or fee. This filtered view shows you the list of payments made by your customers on the selected dates.

- Click Download CSV to generate a document of transactions if desired.

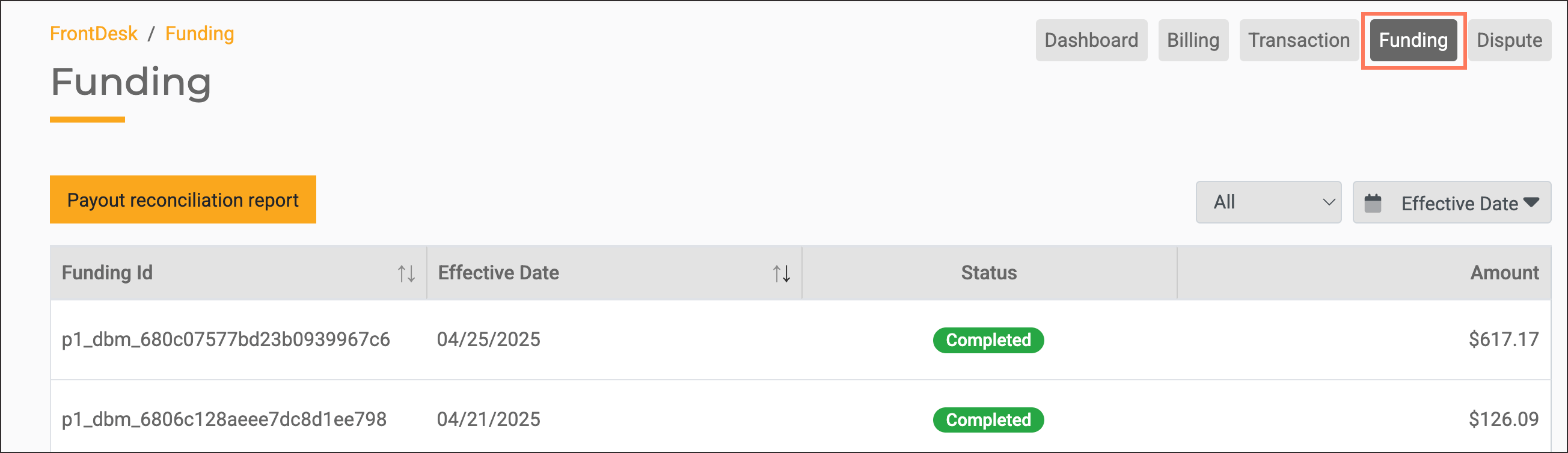

Reconciling Deposits with Funding Reports

To understand what constitutes a bank deposit:

- Go to Front Desk|Payments|Funding

- To generate the report, Click Payout Reconciliation Report:

- Set a date range (ideally one day per report for clarity).

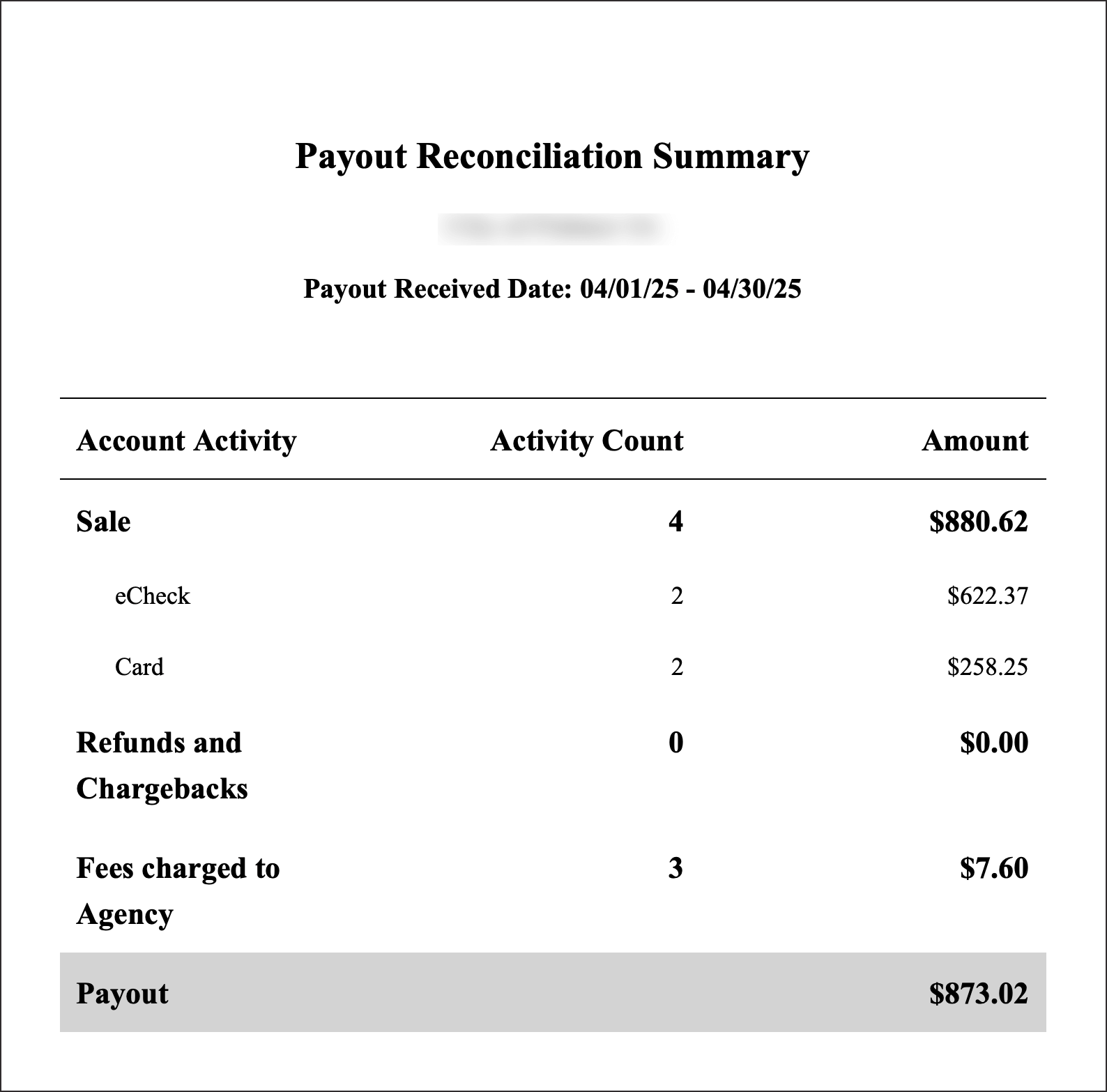

This report shows:

- The Total amount deposited.

- Breakdown of payment types (eChecks, Credit Cards).

- Fees deducted.

- Final amount transferred to your bank.

Note: Fees are deducted before the deposit is made—gWorks Payments does not bill you separately.

For example:

- Total Payments: $150.00

- Return Fee: -$10.00

- Other Fees: -$5.00

- Deposit Amount: $135.00

Understanding Standard Fees- gWorks Payment Charges Definitions

Credit Card/Debit Card fees:

- Cost to process the credit card/debit card payment.

ACH fees:

- Cost to process the ACH payment

Account updater service:

- This fee is for the monitoring service.

- This service is to monitor—on behalf of Merchants—and to keep customer payment information up to date. It addresses a common issue in recurring or subscription-based transactions where customer card details may change, leading to failed or declined payments.

- When a customer's payment card expires, is reissued, or undergoes changes like a new account number due to loss or theft, the account updater service automatically updates the merchant's records with the new information. It saves the merchant from manually contacting the customer for updated payment details and ensures a smoother and uninterrupted payment flow.

- Overall, an account updater service helps merchants maintain accurate customer payment information, reduce declined transactions, and minimize customer churn caused by expired or outdated cards. It streamlines the payment process, improves customer experience, and helps businesses maintain a consistent revenue stream in recurring payment scenarios.

Tip: The Account Updater Service is cool. Very beneficial to merchants!

Account updater fees:

- This fee is for when the monitoring service has to update a payment record on behalf of the Merchant.

Per Chargeback:

- A chargeback is a dispute resolution mechanism provided to consumers who use payment cards, such as credit or debit cards, to make purchases. It allows cardholders to request a refund for a transaction directly from their card-issuing bank. Chargebacks serve as a consumer protection measure and are designed to protect cardholders from fraudulent or unauthorized transactions and provide recourse for unsatisfactory purchases.

- Chargebacks incur fees and penalties from their payment processor or acquiring bank. Excessive chargebacks can also impact a merchant's reputation and may lead to higher processing fees or even the termination of their payment processing services.

- To mitigate chargebacks, merchants should prioritize customer service, provide clear transaction descriptions, promptly address customer concerns, maintain accurate transaction records, and follow best practices to prevent fraudulent activity.

Per Retrieval Request Processed:

- A retrieval request, also known as a "copy request" or "transaction inquiry," is a process in payments processing where a card-issuing bank requests additional information or documentation from a merchant regarding a specific transaction. Retrieval requests are typically initiated by the cardholder's bank as part of the chargeback process or to resolve a dispute.

- Retrieval requests are an important step in the chargeback process as they allow the cardholder's bank to gather more information before making a final decision. It provides an opportunity for the merchant to provide evidence and documentation to support the validity of the transaction, potentially resolving the dispute without proceeding to a chargeback.

- It's essential for merchants to maintain organized transaction records and promptly respond to retrieval requests to increase the likelihood of a favorable resolution. Failure to respond within the specified timeframe or provide sufficient evidence may result in the cardholder's bank proceeding with a chargeback, which can have financial implications for the merchant.

Per Arbitration Case:

- An arbitration case in payments processing refers to a dispute resolution process that occurs when a chargeback dispute between a merchant and a cardholder cannot be resolved through the standard chargeback process. In such cases, either party can escalate the dispute to arbitration, where an independent third party, known as an arbitrator, reviews the evidence and makes a final decision.

- Arbitration cases are typically used when a chargeback dispute becomes complex, involves substantial amounts of money, or requires a more objective and final resolution. The purpose of arbitration is to provide an unbiased decision by an independent party, ensuring a fair resolution for both the merchant and the cardholder.

Per eCheck Return: - An eCheck return, also known as an electronic check return or an ACH return, refers to a situation where an initiated electronic check transaction fails to be successfully processed and is returned to the originator (the payee or merchant). It occurs when the recipient's bank cannot complete the transaction for various reasons, and the funds are not transferred to the intended recipient.

Per eCheck Refund:

- An eCheck refund in payments processing refers to the process of returning funds to a customer or payer who previously made a payment using an electronic check (eCheck). It involves reversing the transaction and crediting the refunded amount back to the customer's bank account.

- It's important to note that the processing time for eCheck refunds can vary depending on factors such as the ACH network's processing timelines, the customer's bank policies, and other variables. Typically, eCheck refunds may take a few business days to be fully processed and reflected in the customer's bank account.

- Merchants should have clear refund policies and procedures in place to handle eCheck refunds efficiently and provide a positive customer experience.

Per Merchant Disbursement Failure:

- A merchant disbursement failure in payments processing refers to a situation where a merchant fails to receive the funds owed to them for successfully processed transactions. It occurs when the payment processor or acquiring bank encounters issues or obstacles that prevent the timely transfer or settlement of funds to the merchant's designated bank account.

- Merchant disbursement failures can have significant financial implications for businesses, leading to cash flow disruptions, operational challenges, and potential strains on their relationship with customers and suppliers. It is important for merchants to maintain open lines of communication with their payment processor or acquiring bank and promptly address any issues that may arise to resolve disbursement failures efficiently.

Per Settlement Fee:

- A settlement refers to the final stage of a transaction where the funds from a customer's payment are transferred from the issuing bank to the acquiring bank or payment processor and ultimately to the merchant's bank account. It is the process of completing the financial exchange between the parties involved in a transaction.

- Merchant Settlement: The settlement funds are transferred to the merchant's bank account, typically within a predefined settlement period determined by the merchant's agreement with the acquiring bank or payment processor. The merchant can access and utilize these funds for their business needs.

- Settlement serves as the final step in the payment processing cycle, ensuring that the merchant receives the funds owed for the authorized transactions. It involves the transfer of funds between multiple parties, including the cardholder's bank, the card networks, the acquiring bank or payment processor, and the merchant's bank account.

- This fee is for when funds are settled in a merchant’s bank account and is a standard industry fee in payment processing. For gWorks Payments, daily settlements equal ~$7 - $7.70 per month in settlement fees.