W2 Report

W2 Report

Preparing your W2s is a simple process in HR Hub. The first step is to run the W2 Report and verify the information is correct.

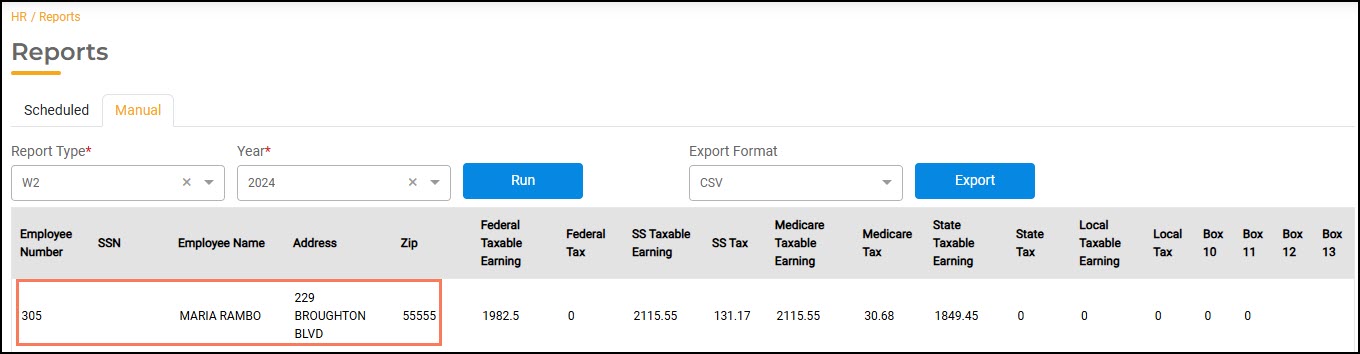

- In HR Hub, select Reports, then click on the Manual, tab.

- Select W2 in the Report Type field and the Year. Then click Run.

- The report will print each employee with their personal and tax information. For each employee, verify the following:

- Name

- Social Security Number

- Address

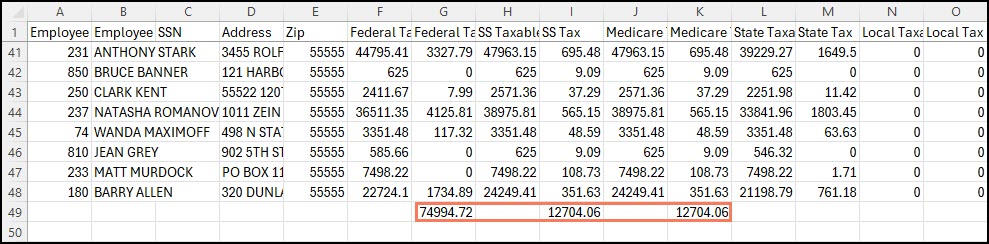

- Once you have verified each employee's information, export the report to CSV. Using the Sum function in excel, you can add the Federal Taxes, Social Security Taxes, and Medicare Taxes. Verify that these totals match your 941s you filed. Keep in mind that the 941s will include both the employer and employee portion of Social Security and Medicare and will be double the total on the W2 Report.Note: If you migrated from SimpleCity, you will need to get your 941s from both SimpleCity and HR Hub and add them together.

It is your responsibility to verify the W-2 information is correct.

It is your responsibility to verify the W-2 information is correct.