Printing and Filing W-2s Electronically

You may print and file your W2s anytime after you have completed the last Payroll Run with a Pay Date in the ending year. W-2s must be distributed to your employees and submitted to the IRS by January 31st. The IRS encourages all employers to file electronically. Employers with more than 10 W-2s must file their W-2s electronically.

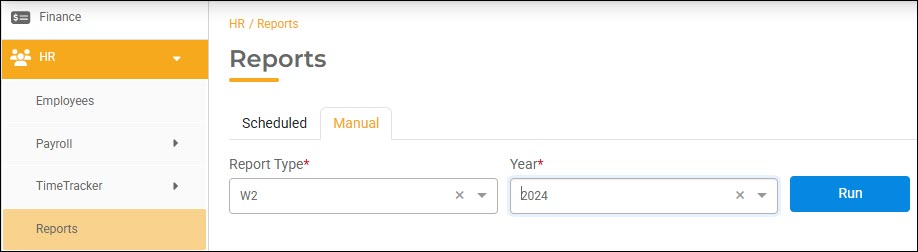

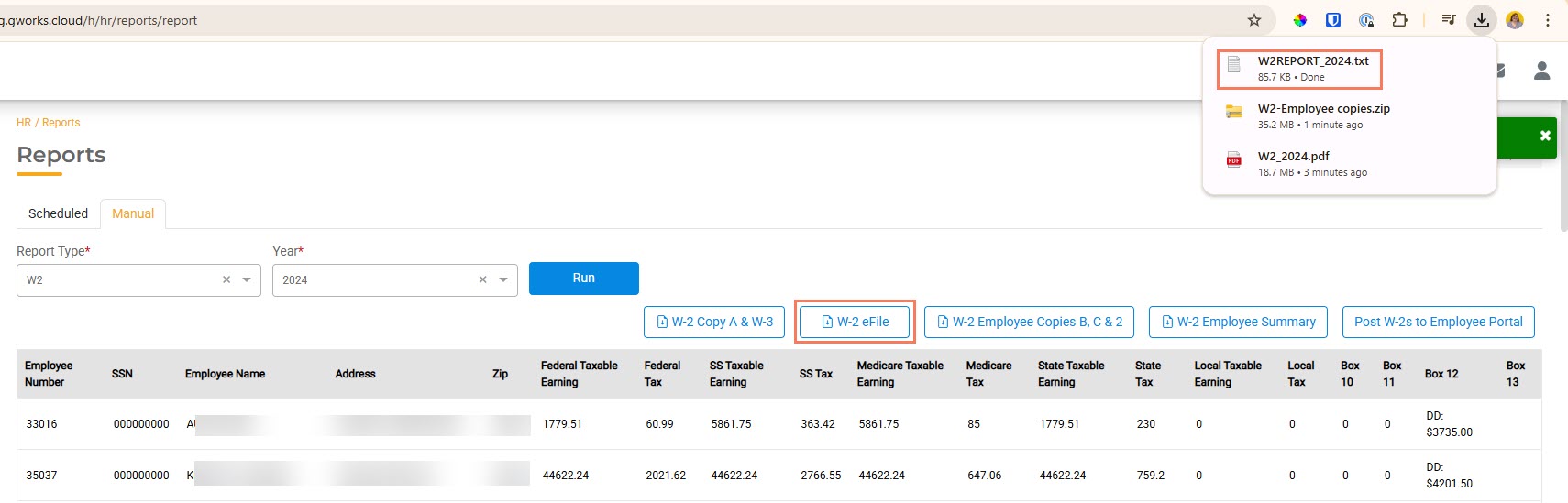

- In HR Hub, select Reports, then click on the Manual tab. Select W2 in the Report Type field. Select the appropriate tax year in the Year field. Click Run.

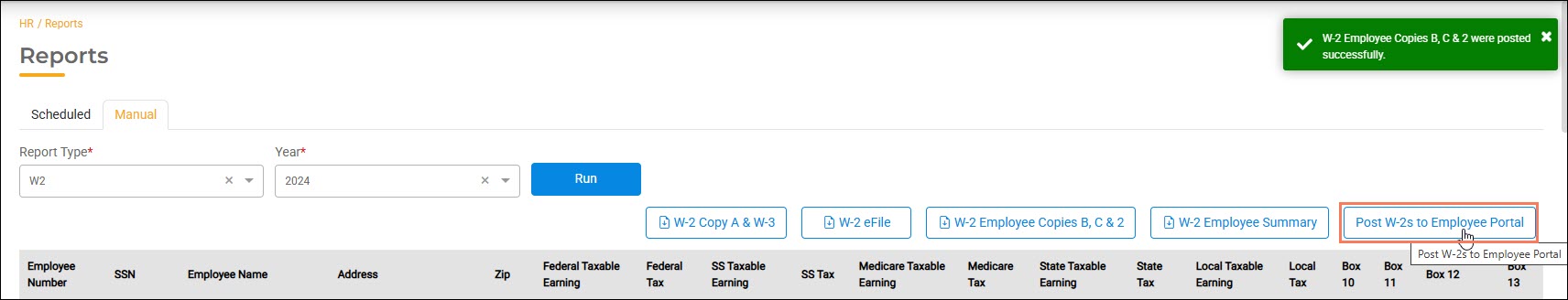

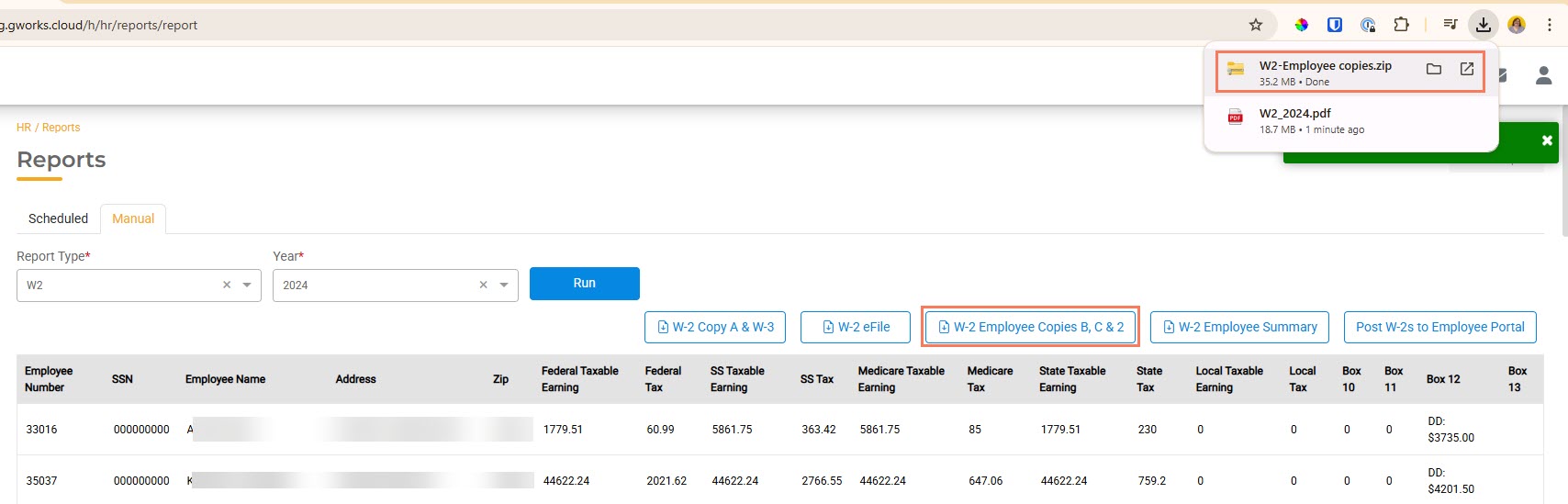

- HR Hub will display each employee who will get a W-2 with their personal information, tax totals, and W2 details. This is what will print on the W-2. Review each employee's information to verify it is correct.It is your responsibility to verify the W-2 information is correct.

- Once you have verified the W-2 information is correct, click Post W-2s to Employee Portal. Employees will have the option to opt into paperless W-2s. Once you post the W-2s to the Employee Portal, they will be able to view their digital W-2 and download it.

- To print employees' W-2 copies, click W-2 Employees Copies B, C & 2. A folder will download with each a PDF of each employee's W-2s into your Downloads folder. Unzip the folder and print each employee's W-2 forms.

- Next, click W-2 eFile. HR Hub will download the appropriate file to your Downloads folder.

- You will need to file electronically with the SSA using your Business Services Login. For information on how to file electronically, see https://www.ssa.gov/bso.

Iowa agencies will need to file with both the Federal government and separately with the State of Iowa at https://govconnect.iowa.gov.

Oklahoma agencies will need to file both the Federal government and separately with the State of Oklahoma at https://oktap.tax.ok.gov/oktap/web/_/.For agencies in Iowa, the W-2 file will have a different name, IAW2-[BEN]-[YYYYMMDDHHMMSS]. You can use this file to file with both the Federal government and the State of Iowa.