How to Set Up & Use Direct Deposit

With HR Hub, you can set up Direct Deposit for your employees and generate an ACH file that can be provided to your Bank to pay them via direct deposit. All employees with direct deposit details configured will be included in the ACH file to receive their payment electronically through ACH transfer. For those who do not have direct deposit set up, you will still have the opportunity to print paper checks.

To configure paper check printing, please read How to Print Paper Checks.

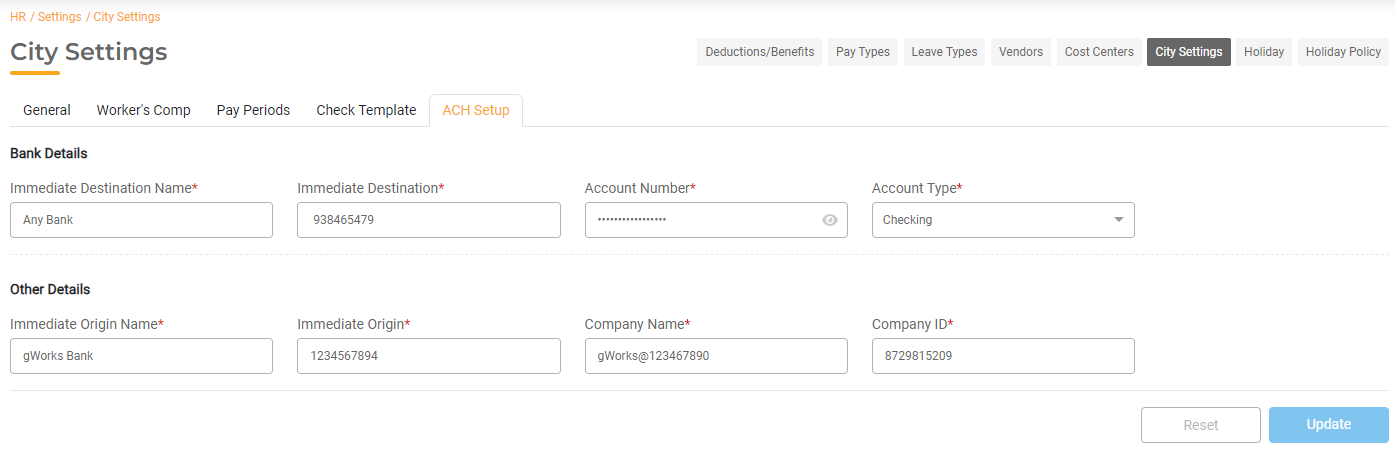

Agency ACH Setup

You must set up your Agency's bank account information to be able to create the ACH file that you will provide to your bank. This is done in HR > Settings > City Settings > ACH Setup. Enter the Bank Details for the bank account from which payroll is paid.

- Bank Details

- Immediate Destination Name: Enter the name of your bank.

- Immediate Destination: This is your bank's Routing Number or the Standard Federal Bank's transit routing number.

- Account Number: Enter the bank account number from which payroll is paid.

- Account Type: Select Checking or Savings.

- Other Details

- Immediate Origin Name: Name of the company sending the file.

- Immediate Origin: Enter your 10-digit company number. If your bank uses the Federal Reserve, this is the Banks' Routing Number.

- Company Name: Name to appear on the receiver's bank statement.

- Company ID: Enter a 1 followed by your EIN number without any spaces.

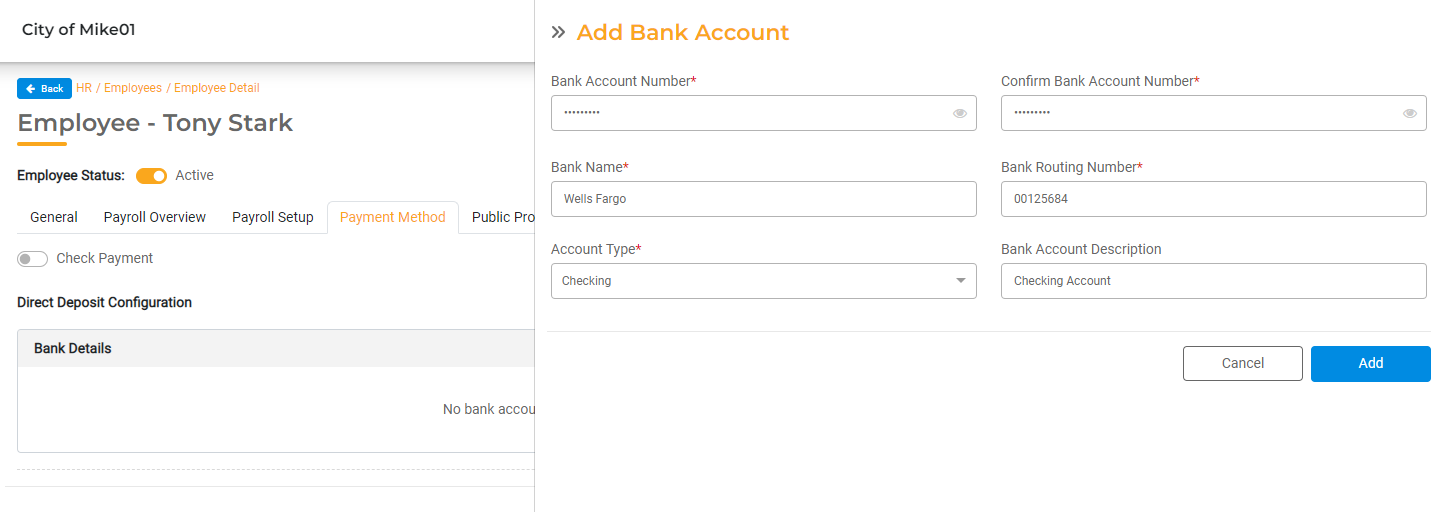

Configuring Direct Deposit for Employees

You must add bank account information and enable direct deposit for each employee who wishes to receive payments electronically. To set up direct deposit, select HR > Employees and select the employee to set up.

In the Employee Detail page, view Payroll Setup > Payment Method. To enable direct deposit, toggle the Check Payment off. Click Add Bank Account. Here you will enter the bank account information for that employee.

- Bank Account Number: Enter the account number of the employee's bank account where the funds will be deposited

- Confirm Bank Account Number: Re-enter the bank account number.

- Bank Name: Enter the name of the employee's bank.

- Bank Routing Number: Enter the routing number for the bank account entered above.

- Account Type: Select whether the account is a checking or savings account.

- Bank Account Description: Enter a description for the bank account.

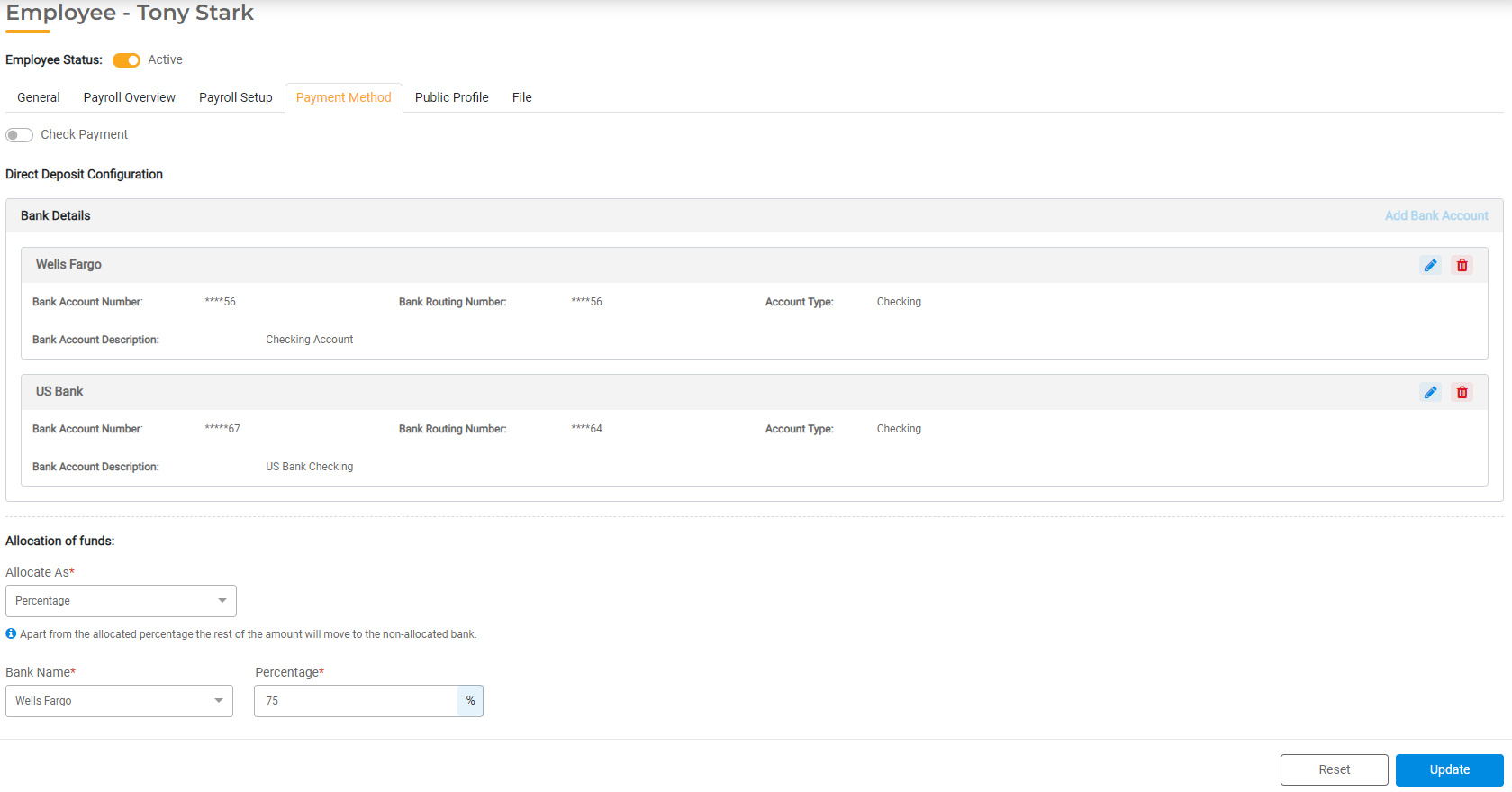

You can add up to two bank accounts for each employee. If more than one bank account has been added, you can enter the percentage or payment amounts that should be deposited in each bank account each time Payroll is processed.

- Select Percentage to define which percentage of each paycheck should go into each Account. Select a bank account and enter the percentage to be applied. The remainder of the check will be deposited into the other bank account.

- Select Amount to define a flat amount that should be deposited into one of the Accounts. In this case, the amount defined here will be deposited into the selected Account. The remainder of the paycheck will be deposited into the other bank account.

Creating the ACH File

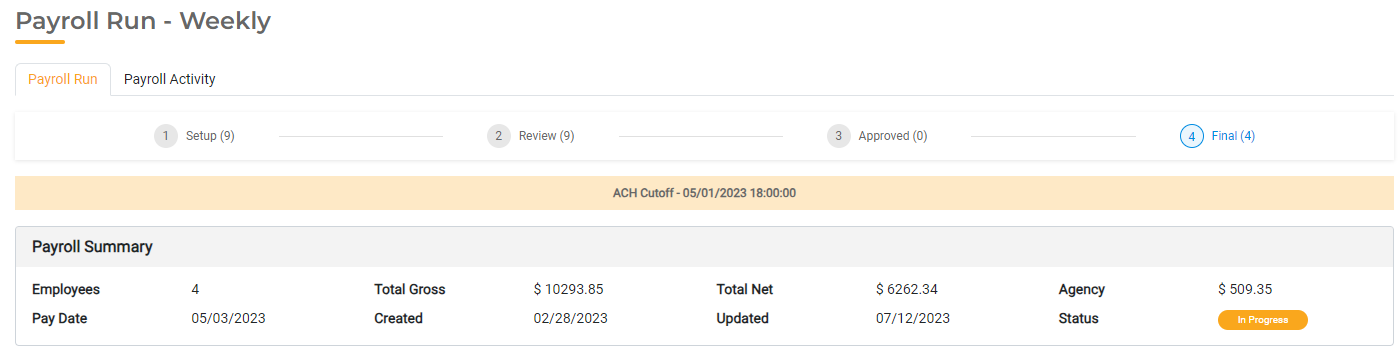

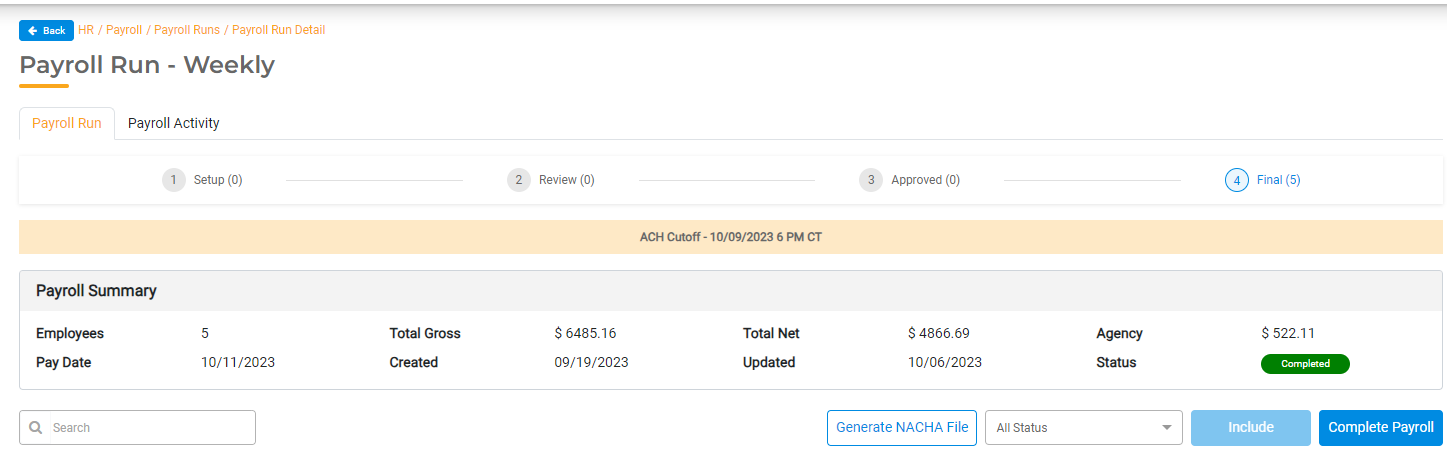

In the final stage of the Payroll run, you'll have the opportunity to create the NACHA file that will be sent to your bank. This NACHA file will contain the payment details for all employees enrolled in direct deposit.

When the payroll has been completed, click Generate NACHA File. This will create a file that can be sent to your bank.

Payment Deadlines

The ACH cutoff date will be the same as the Pay Date. You will be responsible for providing the NACHA file to your bank based on their deadlines. For example, some banks require the file two business days from the date the payment is processed to the date the payment is deposited into your employee's bank account. In this case, you will need to complete the Payroll Run and provide the NACHA file to the bank two days before the Pay Date for your employees to be paid on time.