How Bad Debt Works

If you use Accrual Accounting, Utility Billing Hub allows you to identify and manage Bad Debt. Once a Utility Account balance is unpaid for a considerable time and you no longer expect to receive this revenue, you can mark it as Bad Debt. If a Utility Account is put into Bad Debt, your General Ledger will need to be updated to reflect the loss of revenue. Therefore the General Ledger record will be created and updated in Finance Hub.

Account balances put on Bad Debt can be recoverable. These are called Bad Debt payments. When such payments are received, the General Ledger needs to be updated again.

If the balances are still not paid, you can write off the revenue as non-recoverable, also known as a Bad Debt write-offs. When write-offs are done, the General Ledger needs to be updated again.

Settings: Bad Debt General Ledger Distributions

If your Revenue Recognition is set to Cash Accounting, it means no revenue is recognized when billing takes place. Revenue is only recognized when payments are received. Therefore Bad Debt General Ledger settings are not applicable and Bad Debt settings are not available.

If your Revenue Recognition is set to Accrual Accounting, it means revenue is recognized when billing takes place. Therefore a separate set of General Ledger records are made when the actual payments are received. When an Account is moved to Bad Debt, it means you do not expect to be able to collect the revenue that you have already recognized. Therefore, this set of GL Distributions is only required for cities that use Accrual Accounting

You can specify the General Ledger Account numbers for Bad Debt, Bad Debt Payments, and Bad Debt Write-offs in Utility Billing > Settings > Accounting > GL Distributions. For more information, see How to Configure GL Distributions for Utility Billing.

Flag Accounts as Bad Debt

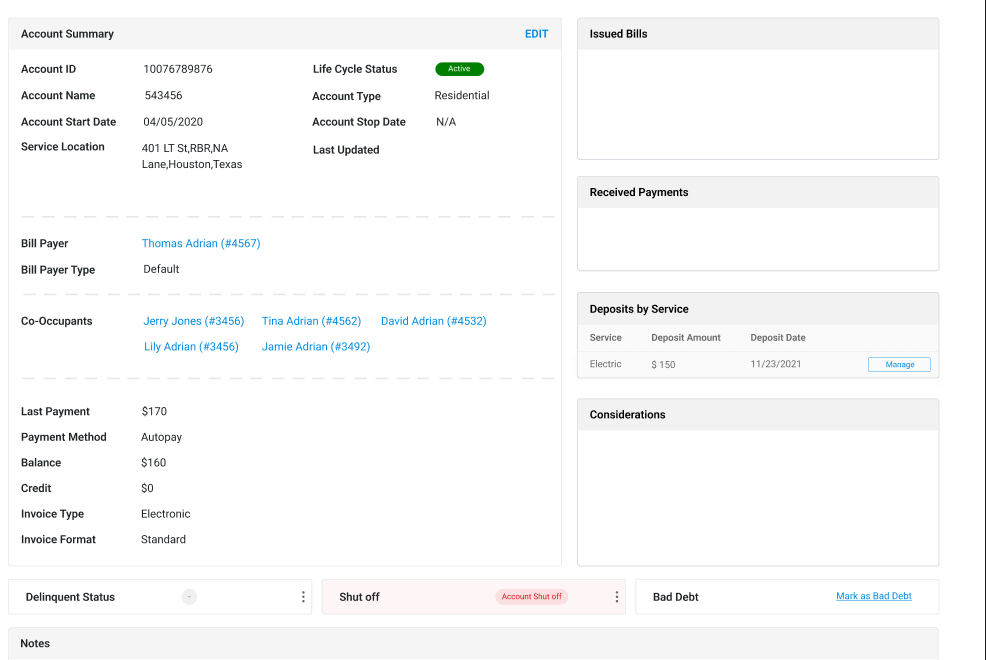

You can mark a Utility Account as Bad Debt from the UtilityAccount Details page. Click Mark as Bad Debt in the Utility Account details page.

The Utility Account will remain Active, but will be moved from the Account master list to the Bad Debt Accounts master list. Once the Utility Account has been moved to Bad Debt, all billing and other processes step.

If you use Accrual Accounting, a Bad Debt GL record should be created based on your GL Distribution for Bad Debt.

The Bad Debt will always remain in the Bill Payer's historical records as well. If the Bill Payer is an Active Public User in FrontDesk, the Public User's record will be flagged there as well. This means that even if the Utility Account gets closed, the Bad Debt record will always be visible for that Public User.

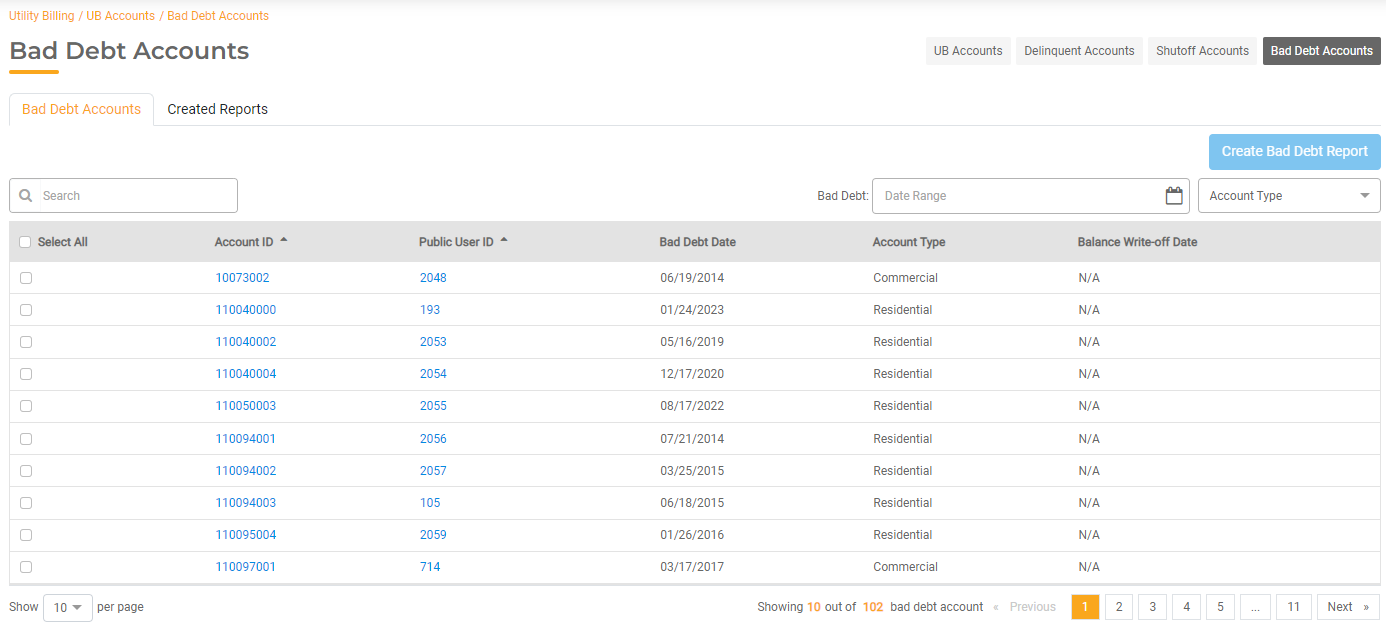

View Bad Debt Accounts

You can view and manage all Bad Debt Utility Accounts in Utility Billing > UB Accounts > Bad Debt Accounts.

To view or edit a record, select it from this list. You will see the Utility Account Detail page where Bad Debt can be managed.

Bad Debt Reports

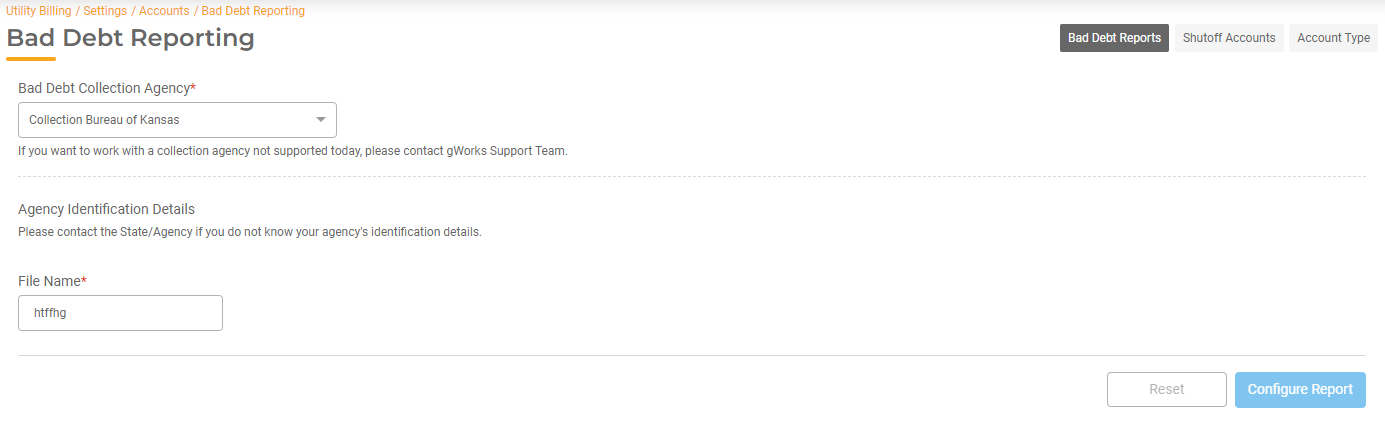

Bad Debt may need to be reported to a third-party agency for collection before it is officially written off.

You can generate a report of Bad Debt Accounts from the Bad Debt Account listing. In Utility Billing > UB Accounts > Bad Debt Accounts. Click Create Bad Debt Report. This will generate a file that can be downloaded and provided to the appropriate third party.

Utility Billing Hub will automatically generate reports for Iowa State, Kansas State Offset, or the Collection Bureau of Kansas. You can configure your Bad Debt Report Format in Utility Billing > Settings > Accounts > Bad Debt Reports. Select one of the available options in the dropdown list. Once the Collection Agency is selected, you can configure your Agency Identification Details along with the File Name.

If you are not in Iowa or Kansas, you do not need to configure this setting.

You also have the ability to view all of the Bad Debt reports from the previous 12 months.

Writing Off Bad Debt

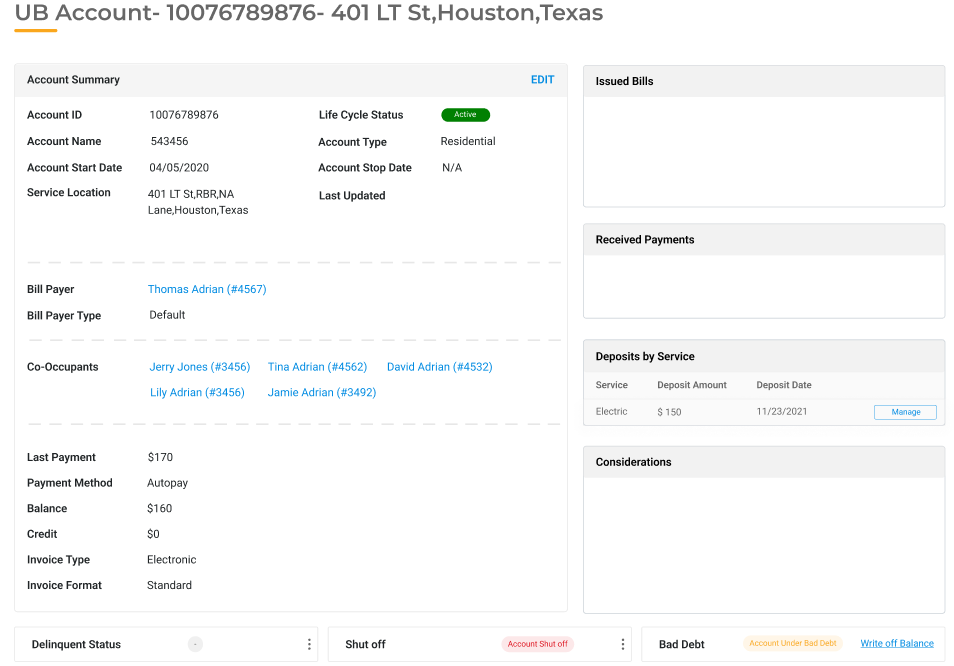

The final step with Bad Debt is writing off the balance so it is removed from the total amount due.

If a Utility Account is marked as Bad Debt, you have the option to click Write off Balance in the Utility Account details page. The complete balance associated with this Utility Account will be written off. The system will generate the corresponding Bad Debt Write-off General Ledger records based on your configuration for Bad Debt Write-offs.

Bad Debt Payments

If a payment is made for a Utility Account that is in Bad Debt, the system will generate a General Ledger record based on your configuration.