How to Exempt Specific Income from a Deduction

HR Hub allows you to apply deductions only to certain Pay Types. Follow the instructions to exclude some Pay Types from the Deduction.

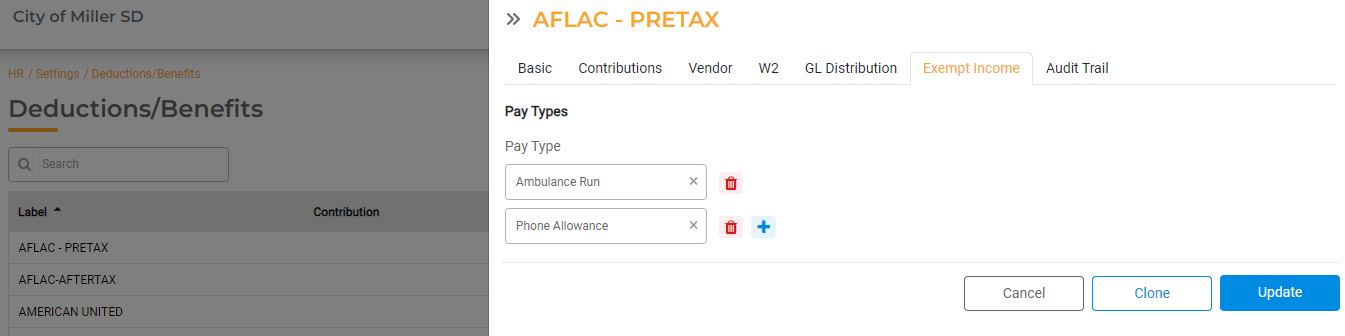

To set up exemptions for a specific Deduction, navigate to the Deductions in HR Hub > Settings > Deductions. Any pay associated with the exempt Pay Type will not count toward the deduction when the Deduction method is set to "Percentage of Income".

For example, if the Percentage Basis is set to Pensionable income, all Pay Types that have the pension flag checked and are not listed under exempt income will be considered to calculate pensionable income. If that Pay Type is listed as Exempt Income, it will not be used to calculate the pensionable income for the deduction.

- In the Basic Tab of the Deduction, turn the toggle for "Exempt Income” on. When this is toggled on, a new tab labeled Exempt Income is available.

- In the Exempt Income tab, add the exempt Pay Types by clicking the + symbol. Select from any Pay Type you have configured.

- You can add one or more Pay Types. Any Pay Type added here will not be subject to this particular Deduction.

- Click Update once the exempt Pay Types have been added.

You can update the exempt Pay Types any time. Any changes made will apply to current Payroll Run as long as the Pay Type is still in the future. The change will also apply to future payroll runs.

If a Primary Pay Type is selected here, any Special Payroll Run to pay Leave Pay, Holiday Pay, or Holiday Overtime Pay will also be exempt from the income to apply deductions. Any overtime (regular overtime or shift overtime) associated with the exempt pay types will be excluded.

If a Primary Pay Type is selected here, any pay for leaves, Holiday Pay, or Holiday Overtime Pay will also be exempt from the income to apply deductions. Any overtime (regular overtime or shift overtime) or differential pay associated with the exempt pay types will be excluded