Printing and Filing 1099s Electronically

If you have vendors who are designated as 1099 vendors and that you paid more than $600 in the previous year, you will need to print and file 1099s. 1099s must be disbursed to vendors by January 31st.

If you are unsure if a vendor should be a 1099 vendor, see their W-9.

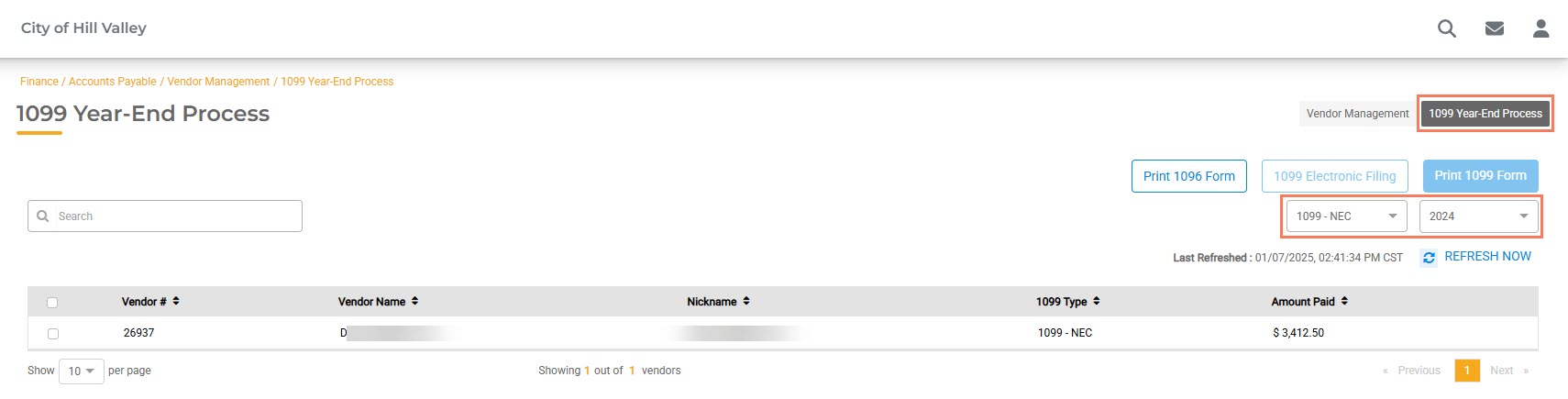

- In Finance Hub select Accounts Payable | Vendor Management. Click on 1099 Year-End Process. Select the 1099 form type and the year. Finance Hub will display each vendor who will receive a 1099. Review each vendor to verify the 1099 information is correct.

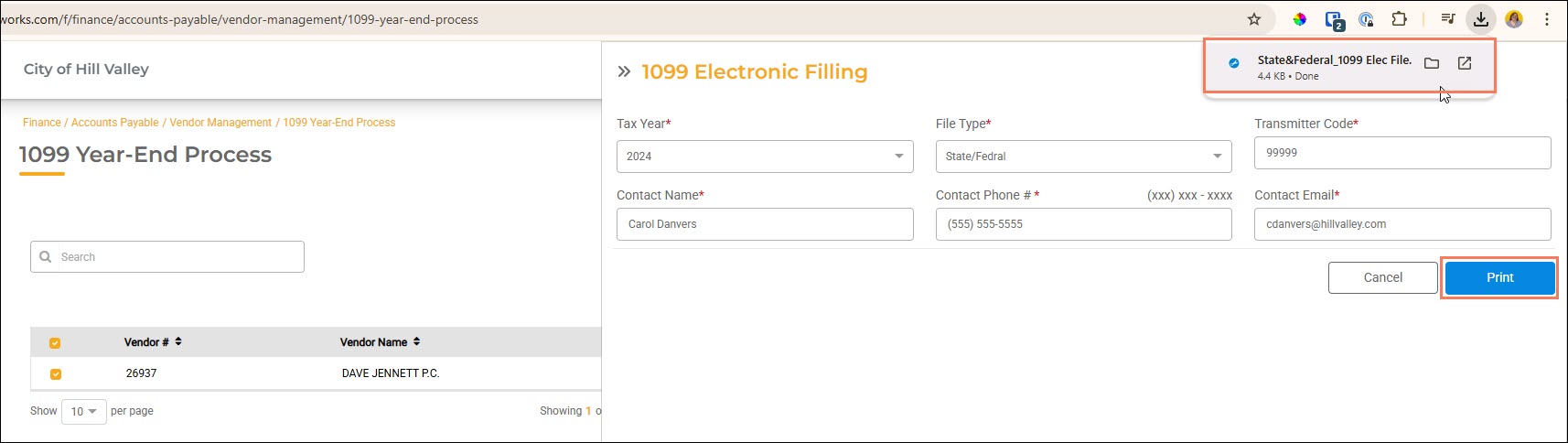

- Once you have verified everything is correct, select all vendors and click 1099 Electronic Filing. A window will open on the right. Select the Tax Year and File Type. Enter your Transmitter Code and your contact information. Click Print. The file will download to your Downloads folder.

- File online at https://www.irs.gov/. If you need assistance, see the IRS website.

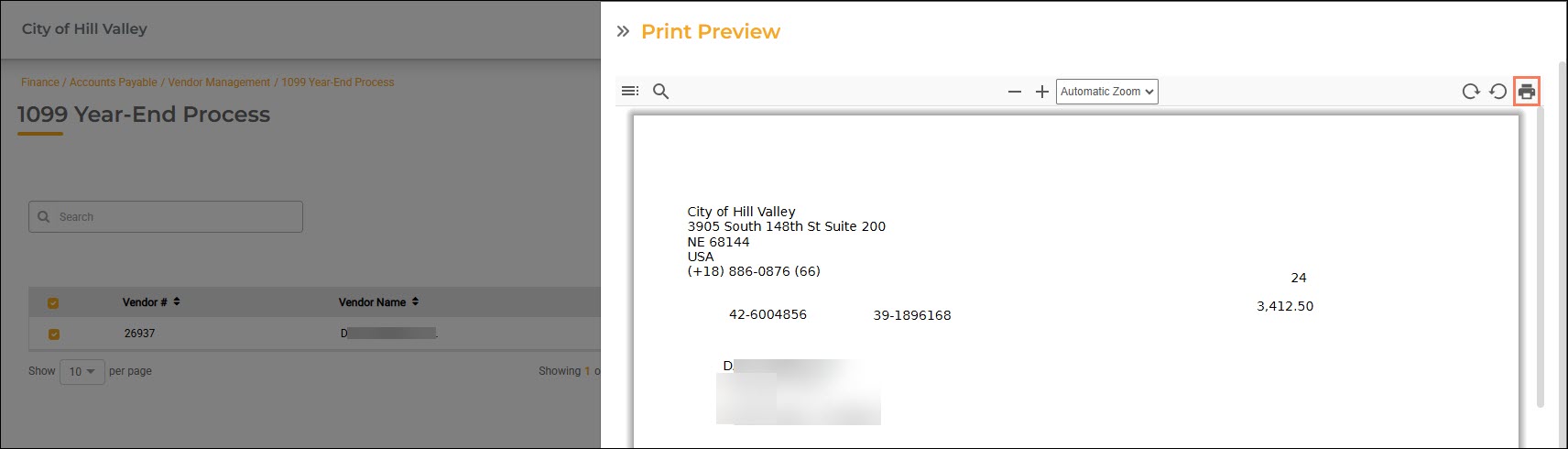

The state of Oklahoma will need to file separately at the Oklahoma Tax Payer Access Point https://oktap.tax.ok.gov/oktap/web/_/. - Next, select all vendors and click Print 1099 Form. Load the 1099 forms into the printer, then click the Print button.If you need to print both 1099 NEC and 1099 MISC forms, you will need to print them in two separate steps.