How to Void Checks in HR Hub

Note: Voiding Payments is only available to internal gWorks Users. If you need assistance voiding a check, please contact gWorks Support to proceed.

A paycheck can be voided for any employee as long as it is done prior to the next Payroll Run for that particular employee. A paycheck for an employee can only be voided until the next payroll for the employee is processed.

When a paycheck is voided, the payment is removed from the payment history for that employee.

To void a check, follow the process below:

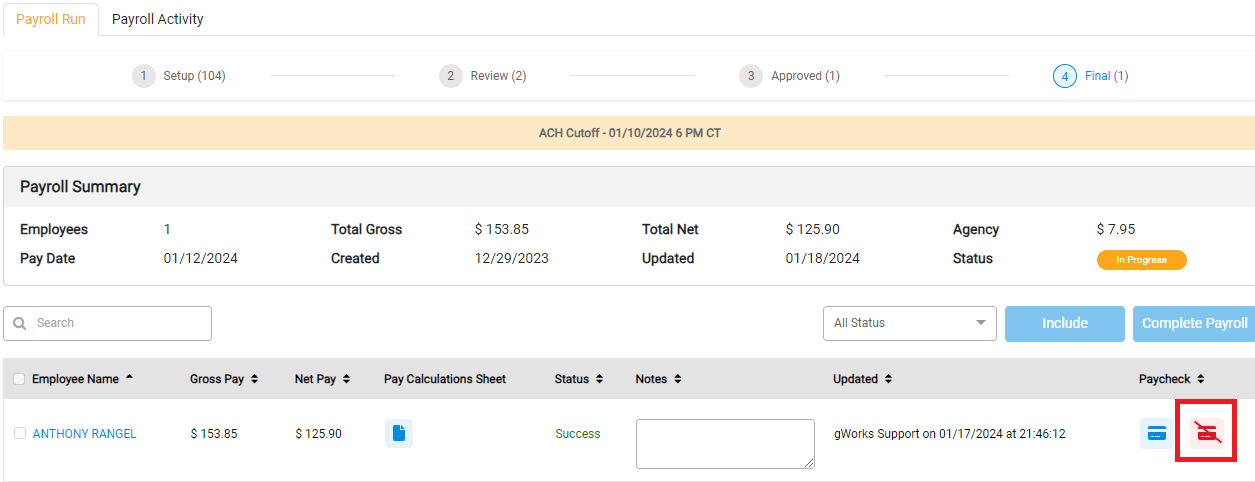

- Go the the Final Stage of the Payroll Run that contains the check you wish to void.

- Select the Void Check icon in the far right column:

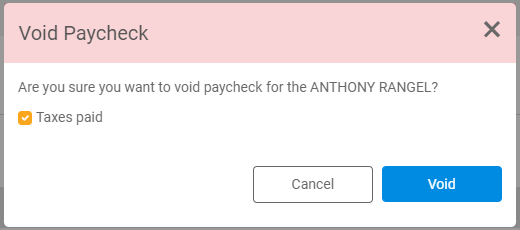

- You will see a popup window with a box that confirms you wish to avoid the paycheck for this employee. Click Void to proceed and void the check.

- If the taxes associated with this paycheck have been paid to the State and Federal Tax authorities, check the box next to "Taxes Paid." This will update the

- If the taxes have not been paid, do not check this box.

Once the check has been voided, the employee will move from the Final phase of the Payroll Run to the Setup phase of the Payroll run. You can re-process Payroll as needed.

If you have not paid the taxes for the voided check, the reports will be updated accordingly with the correct amounts to pay. Any taxes or vendors payments that have already been paid will have to be manually adjusted.

Payroll Reports

The reports will also be updated to show the updated payment history. That includes the following:

- The W2 will not display any voided payments.

- The exports to SimpleCity will be updated to exclude the payment for the voided paycheck. If you have already completed the exports for General Ledger, Accounts Payable, and Bank Reconciliation from Finance Hub, you will need to make the adjustments manually in SimpleCity.

- The Tax Reports for Federal and State Taxes will be updated to exclude the payment. However, if the tax is already paid to the vendor, make sure to check the box for Taxes Paid when voiding the check and these reports will retain the payment made.