How to set up Local Tax Authorities in HR Hub

Some states, such as Pennsylvania, allow for multiple Local Tax Authorities that can be set up at the employee level. Each employee may be subject to one or more local taxes.

Follow the instructions below for how to set up Local Tax Authorities in HR Hub.

Create Local Tax Authorities

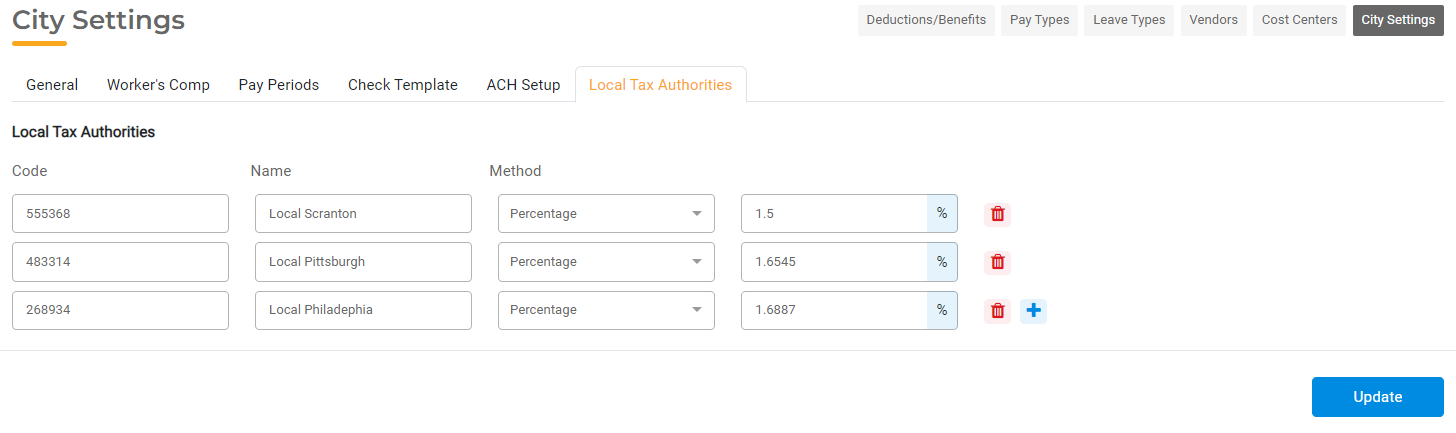

First, you can configure Local Tax Authorities that can then be associated with Employees. You can add Local Tax Authorities in HR Hub > Settings > City Settings > Local Tax Authorities.

- Click the + Symbol to add one or more Local Tax Authorities.

- Enter the following information to set up the Local Tax Authority:

- Code: Enter a combination of numbers and letters. This code will display in a dropdown menu when associating the Tax Authority with an individual employee.

- Name: Enter a name for the Tax Authority.

- Method: Choose whether the tax is a percentage of wages or an amount.

- Enter the Amount or Percent. When percentage is selected, enter the percentage with up to 4 decimal points. When Amount is selected, enter the dollar amount with up to 2 decimal points.

- Enter as many unique codes as needed. You can remove a code from the list by clicking the red trash can icon. When you have all the codes entered, click Update to save the changes.

Associating Local Tax Authorities with Employees

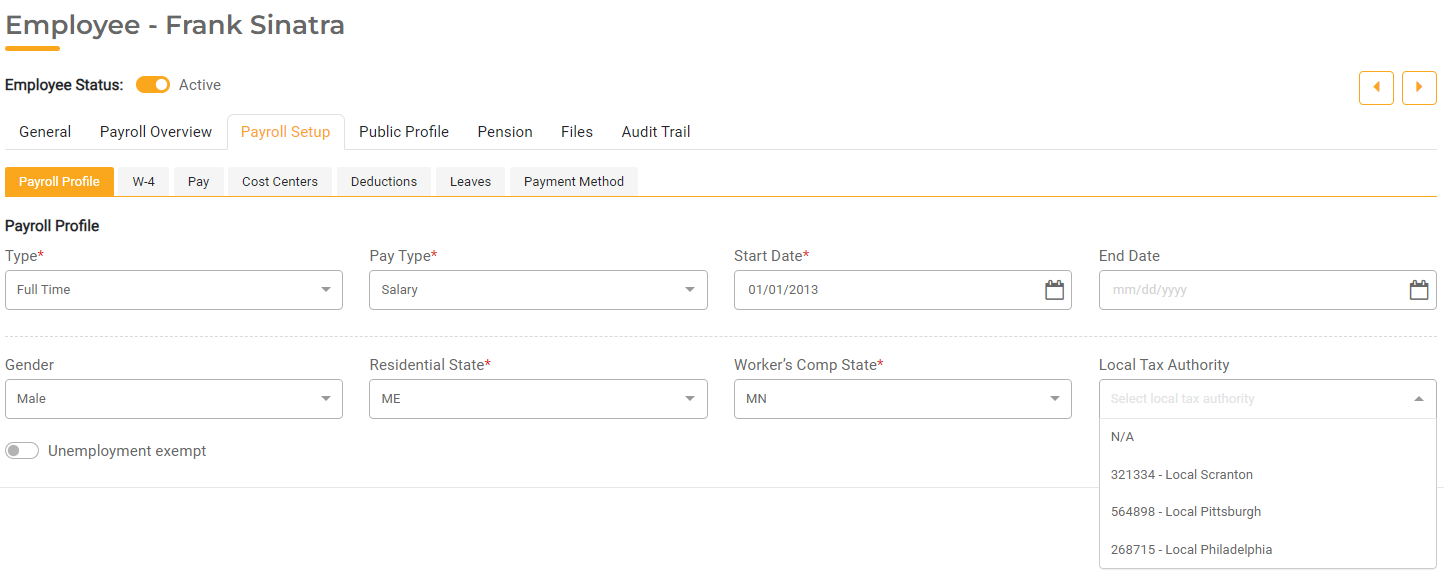

After you've created your Local Tax Authorities, you will associate them with wmployees. In the Employee Setup section, under Payroll Setup > Payroll Profile Tab, there is a field for Local Tax Authority.

This field has a dropdown showing Name and Code. All the values created in the City Settings will be available to choose from. Select the appropriate Local Tax Authority. You can also leave this blank or select N/A if Local Taxes are not applicable for an employee.

Any changes made to the Local Tax Authority will apply to all current and future payrolls for the employee as long as the Pay Date is not in the past.

Any changes will be maintained and can be viewed in the Audit Log for an employee.

Local Tax Calculation

Once Local Tax Districts are associated with an employee, those taxes will be calculated during the Payroll Run. All Pay Types that are marked as having Local Tax Applicable will be included in the calculation.

Leave and Holiday pay will also be subject to local Tax if the Primary Pay Type is subject to local tax. Regular and Shift Overtime are added to the Gross for Local Tax if the Pay Type to which the Overtime is associated is subject to Local Tax.

The Calculation PDF will display the Local Tax if an employee is assigned to a Local Tax Authority.

Local Tax will be displayed on the employee's Paystub under the taxes with Local Tax Authority Name in brackets. If an employee’s Local Tax Authority has changed during the year, separate lines will be shown for each authority to show the YTD for each individual Tax Authority.