How do I correct a Payroll that has been processed?

In the event you applied a Deduction incorrectly, you'll have the opportunity to manually adjust the Deduction the next time you process Payroll for that employee. This will allow you to add a Deduction that was not included with the previous Payroll Run or to subtract a Deduction that was applied by mistake.

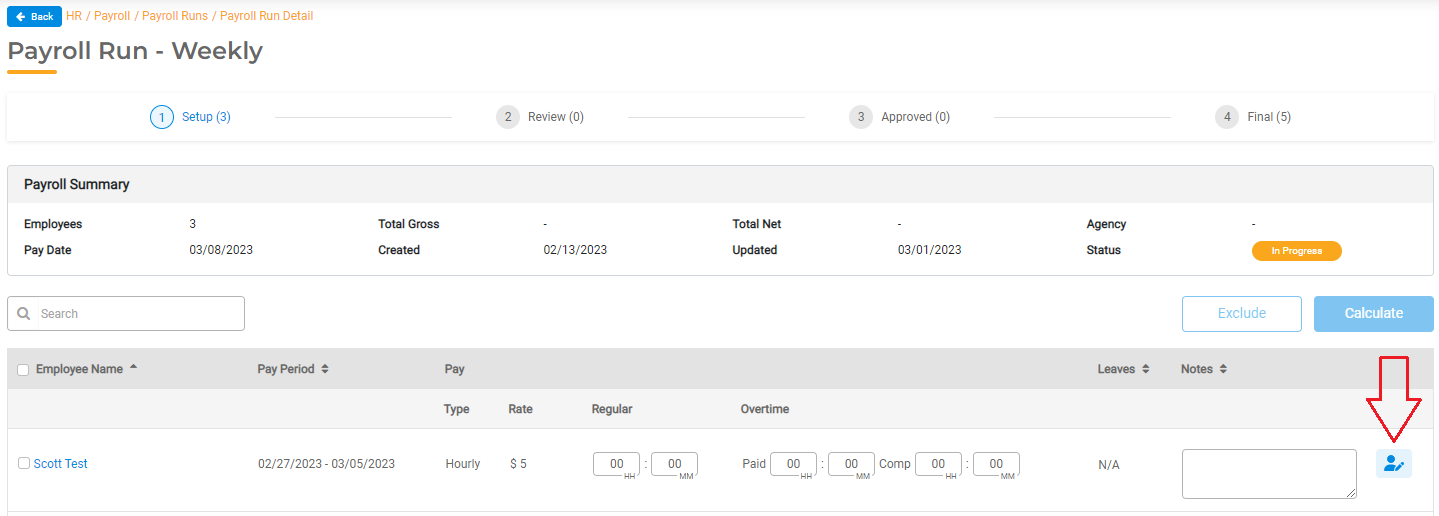

To adjust a Deduction, start a new Payroll Run. In the Setup Stage, you can apply an adjustment by clicking on the Edit icon in the far-right column for that employee.

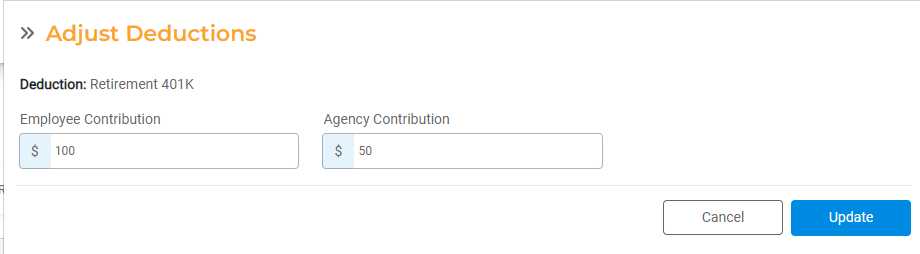

This will open a window where you can adjust a Deduction. All Deductions associated with the employee will display here. You can manually enter the Employee Contribution or the Agency Contribution for any Deduction.

For example, if you did not apply the 401K the previous payroll run, you can double the Employee Contribution and/or the Agency Contribution in the next Payroll Run to account for the missed Deduction.

In the event you overpaid a Deduction, enter a negative value to remove the amount charged in error from the previous Payroll Run.

Click Update to proceed. This update will be applied as a one-time correction for the current Payroll Run. You can view the manually adjusted Deduction in the Review stage of the Payroll run in the calculation sheet.

In the Review Stage, the Gross Pay will include the Deduction Adjustment. To see the full breakdown, you can click on the worksheet icon to review the Deduction.

Continue the Payroll Run process to approve and finalize the employee's pay with the Deduction Adjustment.